Sprott is Well Positioned

Sprott is well positioned for these uncertain times. As our clients and shareholders are aware, our firm has been at the forefront of the notion that systematic risks in the markets have been building for years. We believed that there was bound to be some event that served as a catalyst to a sea-change in the perception and pricing of those risks (see This Tide Will Turn, December 2019).

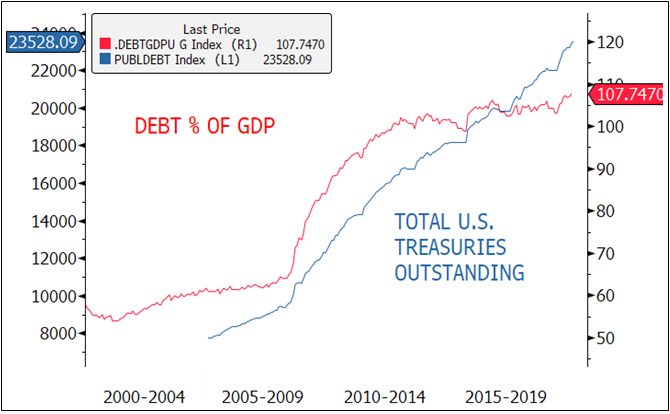

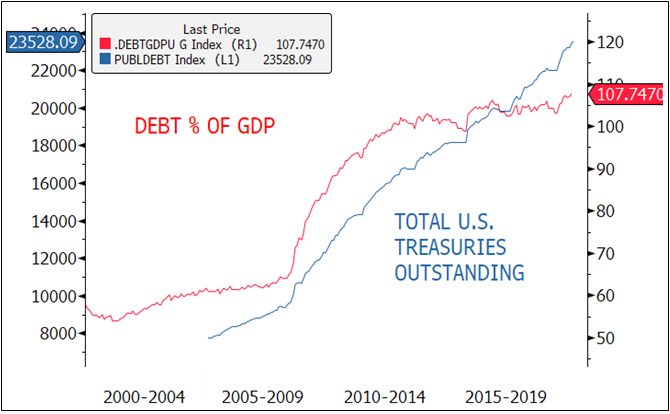

Our thesis has been underpinned by one central premise: that the $250+ trillion build-up in global debt was serving to unnaturally extend the business cycle and asset prices in the same misguided way as during prior bubbles. And, that the economy was no longer growing enough or large enough to support this massive debt balance. We believe it was already, prior to this crisis, an unsolvable equation that had reached its Minsky Moment (see Figure 1).

Figure 1. Debt to GDP Equation No Longer Solvable

Source: Bloomberg. Data as of 3/18/2020.

Concurrently, central banks have become influenced by their political masters and now serve widely to provide the financing and stimulus required to hold the equation in abeyance. Negative interest rates never made sense to us and neither do seemingly permanent budget deficits after a 10-year bull market. Sadly, the coronavirus pandemic has now provided the pin which has burst the bubble.

Long-Term View Unchanged

From the perspective of Sprott and the positioning of our clients and firm, nothing has changed over the last two weeks. Our clients have co-invested with us in gold and related assets to protect their wealth from the current global reset, a strategy that has historically always paid dividends. We are now several giant steps further into the process of financial repression which is required for the "books to balance".

Clearly, more quantitative easing ("QE") needs to be unleashed, no matter what you call it, in order to provide the liquidity the system desperately requires. Interest rates cannot rise without making the situation much worse, so central banks will do what is necessary to keep a lid on rates. Fiscal stimulus is also on the way because even after 10 years of recovery, the economy is nowhere near strong enough to handle the stresses of a coronavirus slowdown. In summary, more low rates, more printing, more budget deficits. Nothing we weren't expecting, just more severe than we anticipated...

Sprott is well positioned for these uncertain times. As our clients and shareholders are aware, our firm has been at the forefront of the notion that systematic risks in the markets have been building for years. We believed that there was bound to be some event that served as a catalyst to a sea-change in the perception and pricing of those risks (see This Tide Will Turn, December 2019).

Our thesis has been underpinned by one central premise: that the $250+ trillion build-up in global debt was serving to unnaturally extend the business cycle and asset prices in the same misguided way as during prior bubbles. And, that the economy was no longer growing enough or large enough to support this massive debt balance. We believe it was already, prior to this crisis, an unsolvable equation that had reached its Minsky Moment (see Figure 1).

Figure 1. Debt to GDP Equation No Longer Solvable

Source: Bloomberg. Data as of 3/18/2020.

Concurrently, central banks have become influenced by their political masters and now serve widely to provide the financing and stimulus required to hold the equation in abeyance. Negative interest rates never made sense to us and neither do seemingly permanent budget deficits after a 10-year bull market. Sadly, the coronavirus pandemic has now provided the pin which has burst the bubble.

Long-Term View Unchanged

From the perspective of Sprott and the positioning of our clients and firm, nothing has changed over the last two weeks. Our clients have co-invested with us in gold and related assets to protect their wealth from the current global reset, a strategy that has historically always paid dividends. We are now several giant steps further into the process of financial repression which is required for the "books to balance".

Clearly, more quantitative easing ("QE") needs to be unleashed, no matter what you call it, in order to provide the liquidity the system desperately requires. Interest rates cannot rise without making the situation much worse, so central banks will do what is necessary to keep a lid on rates. Fiscal stimulus is also on the way because even after 10 years of recovery, the economy is nowhere near strong enough to handle the stresses of a coronavirus slowdown. In summary, more low rates, more printing, more budget deficits. Nothing we weren't expecting, just more severe than we anticipated...

- Source, Peter Grosskopf, CEO of Sprott Asset Management