Most importantly, we believe that gold provided what it should during times of crisis, a form of insurance to cash in when liquidity was required. Gold has lousy margin rates for levered funds and is, by default, one of the first assets to be cashed in when leverage is reduced. We are comforted that throughout this "policy payout," it has mimicked its performance in the GFC, during which it was first sold down by holders requiring funds for other purposes and then skyrocketed once liquidity was rebalanced and QE began in earnest. We believe that long-term investors, not subject to margin pressures, will be similarly rewarded by owning gold at this time.

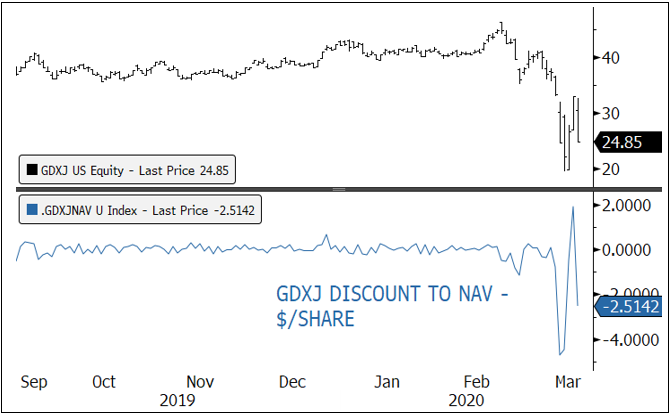

Liquidity concerns also played a prominent role in gold producer equity trading. Gold funds, of which the largest are ETFs, were sold aggressively by margined investors and computer-based traders. The largest gold mining ETFs, the GDX2 and GDXJ,3 were so oversold that they diverged from their closing NAVs by wide margins (see Figure 5). Small- and mid-cap gold stocks lost their bids entirely and fell further from already depressed levels. In our opinion, many now trade under their liquidation values. We remind our clientele that gold producers are enjoying healthy, increasing margins and that their earnings performance should handily outperform other industries in this environment.

Figure 5. Forced Liquidations Causing Dislocation in Gold ETFs

Source: Bloomberg. Data as of 3/18/2020.

Our position on gold is unchanged, which is that it should become a preferred currency and liquidity position for investors, with an essential utility as an insurance policy for more difficult markets to come. Artificially-sponsored negative real rates are already severely damaging purchasing power within portfolios. Permanent government debt "monetization" began in 2019 and will now need to accelerate. In the long term, we are convinced that this process of unabated money printing will eventually spur inflation. Admittedly, it is challenging to see beyond the short-term deflationary event and the government-doctored CPI statistics to the eventual reflationary process. Fortunately, either way, this environment is nirvana for gold as a real asset with purchasing power protection.

Sprott's Business and Strategy

In my opinion, the past two weeks have highlighted the importance of Sprott and our mission to help our clients preserve wealth in uncertain times. We are brave, contrarian and committed to providing our clients with the best investment opportunities in our sector. Nothing has changed in this strategy save for the pricing of the opportunity.

Sprott, as a company, has never been in better health. Our employees are safe and accustomed to working collaboratively from remote locations. Our margins are strong, our assets and client base are growing and we have multiple opportunities for expansion. We are committed to our dividend policy, which provides our shareholders with a healthy yield and to maintaining a strong balance sheet. We liken Sprott to a management company that earns a royalty from our assets under management and as such, we believe our shares are undervalued and are actively repurchasing them for cancellation.

We advise our clients to add to their gold positions over the coming weeks and to use periods of short-term weakness as buying opportunities.

Be safe, this too shall pass and we will get through this challenging period together.

- Source, Peter Grosskopf, CEO Sprott Inc