An excellent Doomberg article3 states that a "singularity" or Big Bang means that what "transpires on either side is unknowable from here." If so, the financial market playbook following the Global Financial Crisis, in which the Fed provided liquidity through expansion of its balance sheet by driving financial asset valuations to unheard of extremes, must be tossed aside.

The Fed's Torturous Path

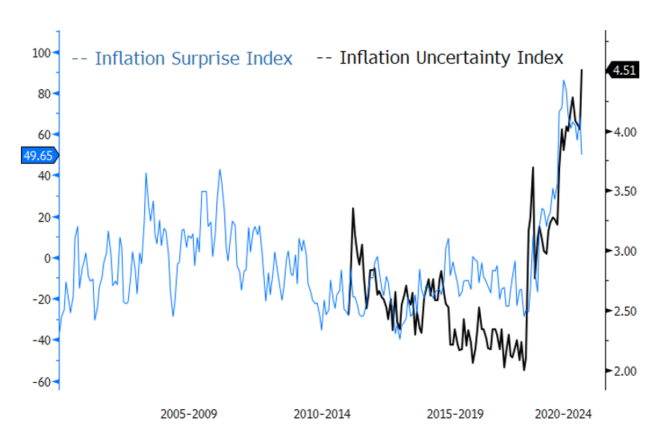

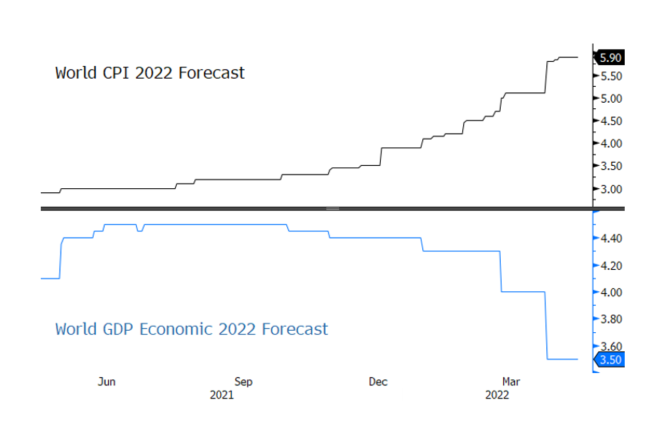

Given the negative supply and demand picture against a backdrop of persistent high inflation, one must ask, how high do interest rates need to rise to compensate rational investors? That level is most likely greater than whatever the Fed has determined to be the so-called "neutral rate." It is likely to be high enough to cripple the economy and deflate financial assets.

Fed policy would no longer be the fulcrum of financial markets. Counterparty distrust would disconnect real assets from nominal claims. A financial market Big Bang could trigger a long-term decline in the financialization of commodities, including gold.

The traditional framework for understanding the economy, inflation, interest rates and other macroeconomic forces assumed an international order based on the U.S. dollar as the primary reserve currency.

The traditional framework for understanding the economy, inflation, interest rates and other macroeconomic forces assumed an international order based on the U.S. dollar as the primary reserve currency.

The Russia-Ukraine War could mark a tipping point that significantly diminishes the pool of offshore capital to finance U.S. deficits. The repercussion would be a severe mismatch between supply and investment demand for U.S. Treasuries. Two additional factors will exacerbate the mismatch: aggressive Fed balance sheet reduction and unexpectedly high deficits caused by the impending recession.

The Fed's Torturous Path

Given the negative supply and demand picture against a backdrop of persistent high inflation, one must ask, how high do interest rates need to rise to compensate rational investors? That level is most likely greater than whatever the Fed has determined to be the so-called "neutral rate." It is likely to be high enough to cripple the economy and deflate financial assets.

The road to equilibrium interest rates promises to be far more torturous than that contemplated by the investment consensus. Thanks to Putin's currency gambit, that road has become the central investment issue of the moment. The belief that Fed policies are adequate for the task seems highly flawed. Respected observers, including Mohamed El-Erian,4 have concluded that it will be impossible for the Fed to thread the needle between taming inflation and causing a recession.

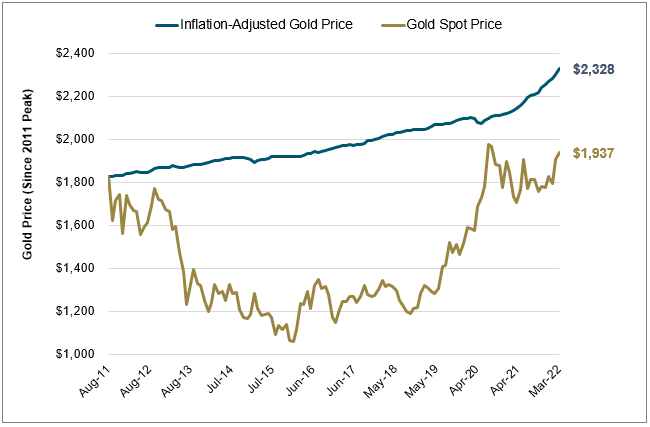

Since the June 2021 Federal Open Market Committee (FOMC) meeting, the prospect of higher interest rates, as per the policy design of the Fed, has been the major headwind for gold. We now believe that rising rates, driven by market forces, will become the tailwind. Investors have been able to overlook the negative investment outlook for debt and interest rates as long as the Fed and foreign investors have absorbed the flows. Now that these two sources of demand could be drying up, they may not be able to handle the truth.*

The state of U.S. sovereign debt is precarious and can no longer be swept under the rug. U.S. debt-to-gross domestic product (GDP) is now the highest in history (Figure 4). The stage is set for a significant devaluation of the U.S. dollar against gold, in our opinion. Investors must act accordingly.

In conclusion, it is our opinion that the investment fundamentals have improved dramatically for gold. That is why, in our opinion, significant upside lies ahead for gold bullion and gold mining equities (Figure 5).

Figure 4. U.S. Federal Debt to U.S. GDP (1789-2022)

Source: MacroTrends and Bloomberg as of October 2021, the latest available data at the time of writing. Reflects the average of debt/GDP per calendar year, with the exception of the October 2021 data point. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Figure 5. Gold Miners Offering Deep Value versus Gold Bullion (1987-2022)

Gold mining equities are now near a 35-year low vs. gold.

Since the June 2021 Federal Open Market Committee (FOMC) meeting, the prospect of higher interest rates, as per the policy design of the Fed, has been the major headwind for gold. We now believe that rising rates, driven by market forces, will become the tailwind. Investors have been able to overlook the negative investment outlook for debt and interest rates as long as the Fed and foreign investors have absorbed the flows. Now that these two sources of demand could be drying up, they may not be able to handle the truth.*

The state of U.S. sovereign debt is precarious and can no longer be swept under the rug. U.S. debt-to-gross domestic product (GDP) is now the highest in history (Figure 4). The stage is set for a significant devaluation of the U.S. dollar against gold, in our opinion. Investors must act accordingly.

In conclusion, it is our opinion that the investment fundamentals have improved dramatically for gold. That is why, in our opinion, significant upside lies ahead for gold bullion and gold mining equities (Figure 5).

Figure 4. U.S. Federal Debt to U.S. GDP (1789-2022)

Source: MacroTrends and Bloomberg as of October 2021, the latest available data at the time of writing. Reflects the average of debt/GDP per calendar year, with the exception of the October 2021 data point. Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Figure 5. Gold Miners Offering Deep Value versus Gold Bullion (1987-2022)

Gold mining equities are now near a 35-year low vs. gold.

- Source, Sprott