Bonterra Resources is a smaller company with a market capitalization of CA$123m, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutions own shares in the company. Let’s take a closer look to see what the different types of shareholder can tell us about Bonterra Resources.

What Does The Institutional Ownership Tell Us About Bonterra Resources?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

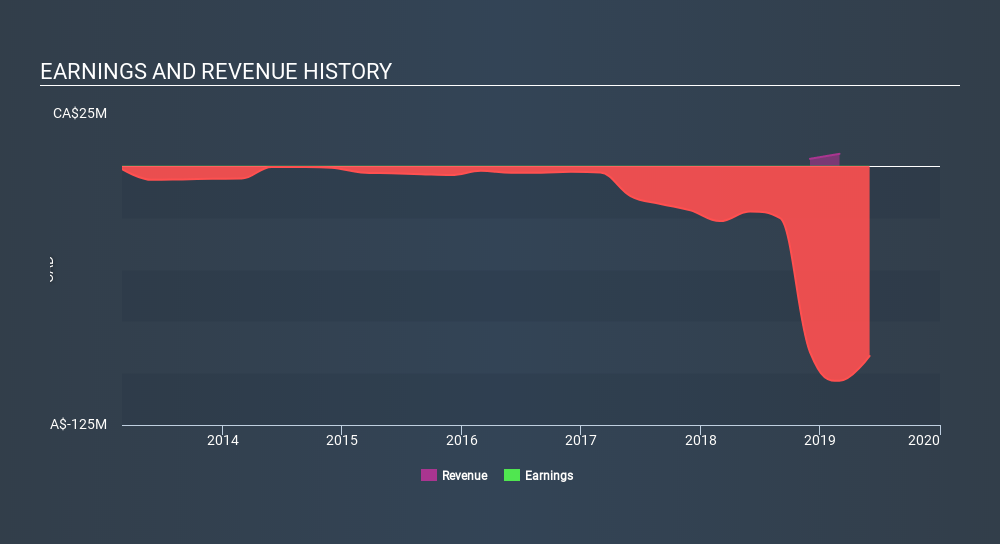

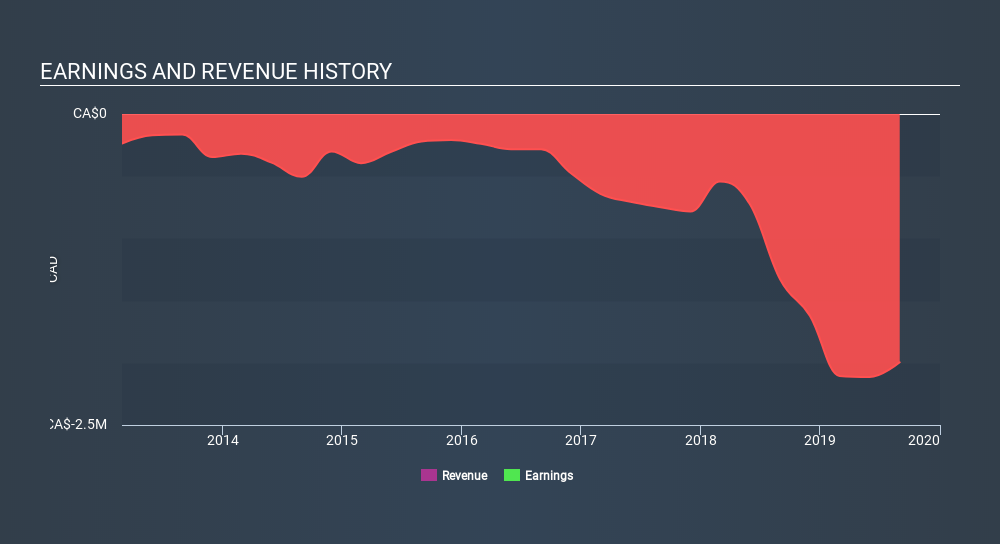

Bonterra Resources already has institutions on the share registry. Indeed, they own 21% of the company. This suggests some credibility amongst professional investors. But we can’t rely on that fact alone, since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Bonterra Resources’s historic earnings and revenue, below, but keep in mind there’s always more to the story.

It would appear that 16% of Bonterra Resources shares are controlled by hedge funds. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. Looking at our data, we can see that the largest shareholder is Wexford Capital LP with 16% of shares outstanding. Kirkland Lake Gold Ltd. is the second largest shareholder with 11% of common stock, followed by Eric Sprott, holding 6.7% of the stock.

On studying the facts and figures more closely, we found that 7 of the top shareholders account for 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

- Source, Simply Wall St.