- Source, Sprott Money

Tracking the Gold and Silver Vigilante, Eric Sprott - An Unofficial tracking of his investment commentary

Tuesday, March 31, 2020

The Impact that the Coronavirus is Having on Precious Metals and Mining Shares

Thursday, March 26, 2020

Gold Trade: Refuge in a Time of Crisis

The raging liquidity vortex seriously impacted the gold price, which retreated more than 10% from its recent peak. We note that the price of gold is always vulnerable when sentiment is overextended and it is over-bought based on technical measures such as RSI (relative strength index) and net commercial versus speculative positions. USD strength last week hurt as well. As usual, the trading of gold was likely dominated by margined entities trading "paper" as opposed to physical transactions, usually by a factor of 100:1 or more.

Most importantly, we believe that gold provided what it should during times of crisis, a form of insurance to cash in when liquidity was required. Gold has lousy margin rates for levered funds and is, by default, one of the first assets to be cashed in when leverage is reduced. We are comforted that throughout this "policy payout," it has mimicked its performance in the GFC, during which it was first sold down by holders requiring funds for other purposes and then skyrocketed once liquidity was rebalanced and QE began in earnest. We believe that long-term investors, not subject to margin pressures, will be similarly rewarded by owning gold at this time.

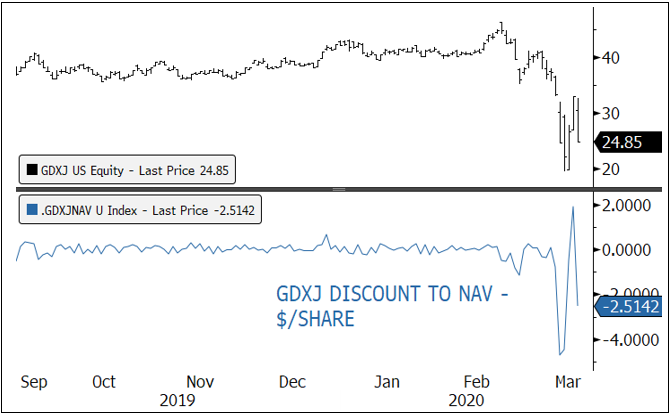

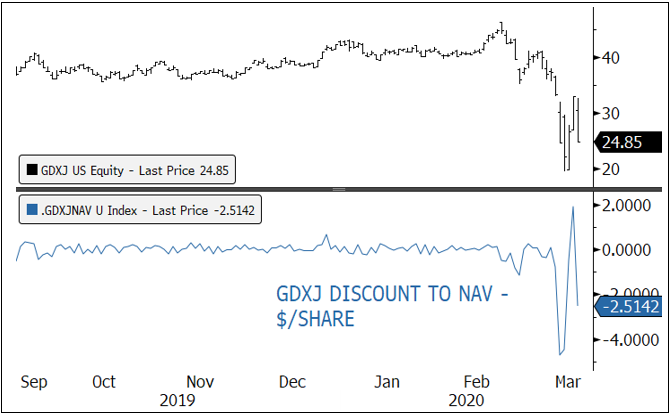

Liquidity concerns also played a prominent role in gold producer equity trading. Gold funds, of which the largest are ETFs, were sold aggressively by margined investors and computer-based traders. The largest gold mining ETFs, the GDX2 and GDXJ,3 were so oversold that they diverged from their closing NAVs by wide margins (see Figure 5). Small- and mid-cap gold stocks lost their bids entirely and fell further from already depressed levels. In our opinion, many now trade under their liquidation values. We remind our clientele that gold producers are enjoying healthy, increasing margins and that their earnings performance should handily outperform other industries in this environment.

Figure 5. Forced Liquidations Causing Dislocation in Gold ETFs

Source: Bloomberg. Data as of 3/18/2020.

Our position on gold is unchanged, which is that it should become a preferred currency and liquidity position for investors, with an essential utility as an insurance policy for more difficult markets to come. Artificially-sponsored negative real rates are already severely damaging purchasing power within portfolios. Permanent government debt "monetization" began in 2019 and will now need to accelerate. In the long term, we are convinced that this process of unabated money printing will eventually spur inflation. Admittedly, it is challenging to see beyond the short-term deflationary event and the government-doctored CPI statistics to the eventual reflationary process. Fortunately, either way, this environment is nirvana for gold as a real asset with purchasing power protection.

Sprott's Business and Strategy

In my opinion, the past two weeks have highlighted the importance of Sprott and our mission to help our clients preserve wealth in uncertain times. We are brave, contrarian and committed to providing our clients with the best investment opportunities in our sector. Nothing has changed in this strategy save for the pricing of the opportunity.

Sprott, as a company, has never been in better health. Our employees are safe and accustomed to working collaboratively from remote locations. Our margins are strong, our assets and client base are growing and we have multiple opportunities for expansion. We are committed to our dividend policy, which provides our shareholders with a healthy yield and to maintaining a strong balance sheet. We liken Sprott to a management company that earns a royalty from our assets under management and as such, we believe our shares are undervalued and are actively repurchasing them for cancellation.

We advise our clients to add to their gold positions over the coming weeks and to use periods of short-term weakness as buying opportunities.

Be safe, this too shall pass and we will get through this challenging period together.

Most importantly, we believe that gold provided what it should during times of crisis, a form of insurance to cash in when liquidity was required. Gold has lousy margin rates for levered funds and is, by default, one of the first assets to be cashed in when leverage is reduced. We are comforted that throughout this "policy payout," it has mimicked its performance in the GFC, during which it was first sold down by holders requiring funds for other purposes and then skyrocketed once liquidity was rebalanced and QE began in earnest. We believe that long-term investors, not subject to margin pressures, will be similarly rewarded by owning gold at this time.

Liquidity concerns also played a prominent role in gold producer equity trading. Gold funds, of which the largest are ETFs, were sold aggressively by margined investors and computer-based traders. The largest gold mining ETFs, the GDX2 and GDXJ,3 were so oversold that they diverged from their closing NAVs by wide margins (see Figure 5). Small- and mid-cap gold stocks lost their bids entirely and fell further from already depressed levels. In our opinion, many now trade under their liquidation values. We remind our clientele that gold producers are enjoying healthy, increasing margins and that their earnings performance should handily outperform other industries in this environment.

Figure 5. Forced Liquidations Causing Dislocation in Gold ETFs

Source: Bloomberg. Data as of 3/18/2020.

Our position on gold is unchanged, which is that it should become a preferred currency and liquidity position for investors, with an essential utility as an insurance policy for more difficult markets to come. Artificially-sponsored negative real rates are already severely damaging purchasing power within portfolios. Permanent government debt "monetization" began in 2019 and will now need to accelerate. In the long term, we are convinced that this process of unabated money printing will eventually spur inflation. Admittedly, it is challenging to see beyond the short-term deflationary event and the government-doctored CPI statistics to the eventual reflationary process. Fortunately, either way, this environment is nirvana for gold as a real asset with purchasing power protection.

Sprott's Business and Strategy

In my opinion, the past two weeks have highlighted the importance of Sprott and our mission to help our clients preserve wealth in uncertain times. We are brave, contrarian and committed to providing our clients with the best investment opportunities in our sector. Nothing has changed in this strategy save for the pricing of the opportunity.

Sprott, as a company, has never been in better health. Our employees are safe and accustomed to working collaboratively from remote locations. Our margins are strong, our assets and client base are growing and we have multiple opportunities for expansion. We are committed to our dividend policy, which provides our shareholders with a healthy yield and to maintaining a strong balance sheet. We liken Sprott to a management company that earns a royalty from our assets under management and as such, we believe our shares are undervalued and are actively repurchasing them for cancellation.

We advise our clients to add to their gold positions over the coming weeks and to use periods of short-term weakness as buying opportunities.

Be safe, this too shall pass and we will get through this challenging period together.

- Source, Peter Grosskopf, CEO Sprott Inc

Monday, March 23, 2020

More Quantitative Easing to be Unleashed, Debt to GDP Now Unsolvable

It has been a very difficult couple of weeks for the precious metals complex, the financial markets and the general population. No doubt that the impacts of the coronavirus outbreak will be shouldered by many over both the short and long terms. Some industries, such as travel and hospitality, will require assistance while others, such as medical and long-term care, will need massive investment. I trust that our collective resilience and determination will prevail and that the vast majority of us will be safe and more grateful than we were before 2020.

Sprott is Well Positioned

Sprott is well positioned for these uncertain times. As our clients and shareholders are aware, our firm has been at the forefront of the notion that systematic risks in the markets have been building for years. We believed that there was bound to be some event that served as a catalyst to a sea-change in the perception and pricing of those risks (see This Tide Will Turn, December 2019).

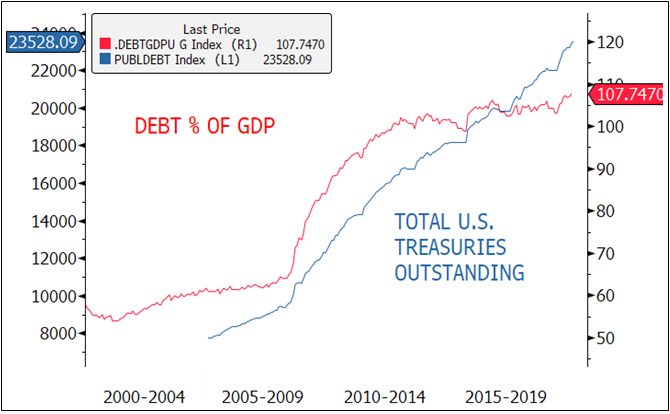

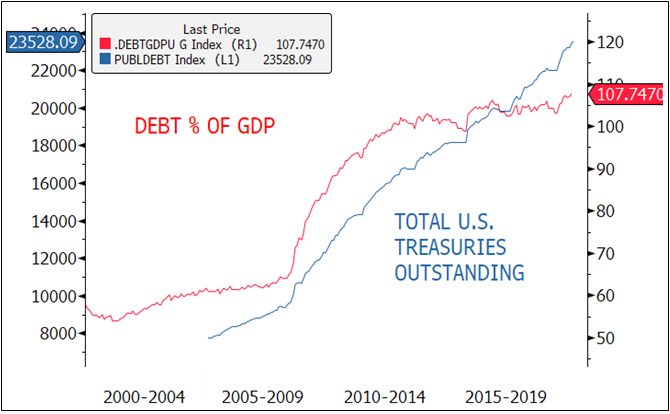

Our thesis has been underpinned by one central premise: that the $250+ trillion build-up in global debt was serving to unnaturally extend the business cycle and asset prices in the same misguided way as during prior bubbles. And, that the economy was no longer growing enough or large enough to support this massive debt balance. We believe it was already, prior to this crisis, an unsolvable equation that had reached its Minsky Moment (see Figure 1).

Figure 1. Debt to GDP Equation No Longer Solvable

Source: Bloomberg. Data as of 3/18/2020.

Concurrently, central banks have become influenced by their political masters and now serve widely to provide the financing and stimulus required to hold the equation in abeyance. Negative interest rates never made sense to us and neither do seemingly permanent budget deficits after a 10-year bull market. Sadly, the coronavirus pandemic has now provided the pin which has burst the bubble.

Long-Term View Unchanged

From the perspective of Sprott and the positioning of our clients and firm, nothing has changed over the last two weeks. Our clients have co-invested with us in gold and related assets to protect their wealth from the current global reset, a strategy that has historically always paid dividends. We are now several giant steps further into the process of financial repression which is required for the "books to balance".

Clearly, more quantitative easing ("QE") needs to be unleashed, no matter what you call it, in order to provide the liquidity the system desperately requires. Interest rates cannot rise without making the situation much worse, so central banks will do what is necessary to keep a lid on rates. Fiscal stimulus is also on the way because even after 10 years of recovery, the economy is nowhere near strong enough to handle the stresses of a coronavirus slowdown. In summary, more low rates, more printing, more budget deficits. Nothing we weren't expecting, just more severe than we anticipated...

Sprott is well positioned for these uncertain times. As our clients and shareholders are aware, our firm has been at the forefront of the notion that systematic risks in the markets have been building for years. We believed that there was bound to be some event that served as a catalyst to a sea-change in the perception and pricing of those risks (see This Tide Will Turn, December 2019).

Our thesis has been underpinned by one central premise: that the $250+ trillion build-up in global debt was serving to unnaturally extend the business cycle and asset prices in the same misguided way as during prior bubbles. And, that the economy was no longer growing enough or large enough to support this massive debt balance. We believe it was already, prior to this crisis, an unsolvable equation that had reached its Minsky Moment (see Figure 1).

Figure 1. Debt to GDP Equation No Longer Solvable

Source: Bloomberg. Data as of 3/18/2020.

Concurrently, central banks have become influenced by their political masters and now serve widely to provide the financing and stimulus required to hold the equation in abeyance. Negative interest rates never made sense to us and neither do seemingly permanent budget deficits after a 10-year bull market. Sadly, the coronavirus pandemic has now provided the pin which has burst the bubble.

Long-Term View Unchanged

From the perspective of Sprott and the positioning of our clients and firm, nothing has changed over the last two weeks. Our clients have co-invested with us in gold and related assets to protect their wealth from the current global reset, a strategy that has historically always paid dividends. We are now several giant steps further into the process of financial repression which is required for the "books to balance".

Clearly, more quantitative easing ("QE") needs to be unleashed, no matter what you call it, in order to provide the liquidity the system desperately requires. Interest rates cannot rise without making the situation much worse, so central banks will do what is necessary to keep a lid on rates. Fiscal stimulus is also on the way because even after 10 years of recovery, the economy is nowhere near strong enough to handle the stresses of a coronavirus slowdown. In summary, more low rates, more printing, more budget deficits. Nothing we weren't expecting, just more severe than we anticipated...

- Source, Peter Grosskopf, CEO of Sprott Asset Management

Friday, March 20, 2020

Eric Sprott: Collapsing Global Markets and it's Impact on Precious Metals

- Source, Sprott Money

Wednesday, March 11, 2020

Novo Agrees to Acquire Significant Stake in New Found Gold Corp.

Upon closing of the Acquisition and assuming no further share issuances by New Found or Novo, Novo will own approximately 15.97% of the issued and outstanding shares of New Found and New Found will own approximately 3.73% of the issued and outstanding common shares of Novo. The Acquisition gives Novo a significant stake in yet another promising new gold field and, coupled with the Company’s recent investment in ASX-listed Kalamazoo Resources Limited, further diversifies the Company’s passive exposure to potentially significant discoveries worldwide.

New Found is focused on exploring its wholly-owned Queensway project (the “Queensway Project”) located near the town of Gander, Central Newfoundland. The first hole from its late 2019 drill program (NFGC-19-01) on the Queensway Project intersected 92.86 g/t Au over 19.0

The Queensway Project comprises 85 km of prospective strike length with strong geological indications that much of the property falls within the prospective high-grade

The Province of Newfoundland and Labrador is a favorable exploration and mining jurisdiction. The Province recently launched the “Mining the Future 2030” initiative which envisions five new mines, direct employment of a diverse workforce of more than 6,200 people, CAD $4 billion in annual mineral shipments, and CAD $100 million in exploration expenditures by 2030 (please see https://www.gov.nl.ca/releases/2018/exec/1102n05/) and bodes well for the future of the Queensway Project.

Eric Sprott, a director of Novo, currently holds 16.79% of the issued and outstanding shares of New Found immediately prior to the Acquisition. As such, New Found is considered a non-arm’s length party to Novo pursuant to TSX Venture Exchange policies.

Pursuant to the terms of the Acquisition, the Company also has the right to appoint a director to the board of directors of New Found at any time for a period of three years from the Acquisition Date provided that the Company holds no less than 10% of New Found’s issued and outstanding shares. The Company has also agreed to certain voting restrictions for a period of three years.

“We at Novo think the Queensway Project represents a very promising new high-grade gold discovery,” commented Dr. Quinton Hennigh, President and Chairman of Novo Resources. “It appears the Queensway Project encompasses an area highly prospective for high-grade epizonal orogenic gold mineralization. We are very pleased to have the opportunity to be part of this exciting discovery and, upon completion of the Acquisition, look forward to supporting New Found as they advance work around hole NFGC-19-01 and the many other high grade showings across the Queensway Project.”

“We are thrilled to welcome Novo as a significant stakeholder in New Found,” commented Collin Kettel, Executive Chairman and Director of New Found. “Following strategic investments in New Found by Eric Sprott and Rob McEwen last year, we are excited to receive further validation of our team’s discovery at the Queensway Project in Newfoundland. We look forward to working with Dr. Quinton Hennigh and the entire Novo team as we continue to advance the Queensway Project.”

- Source, Yahoo Finance

Saturday, March 7, 2020

Eric Sprott, Terry Lynch: Protect Retail Investors, Let Them Make Money

- Source, Investing News Network

Tuesday, March 3, 2020

Coronavirus Concerns, Protests and More

The Investing News Network also took to the floor (and Twitter) to poll attendees on whether Canada is still attractive as a mining jurisdiction.

- Source, Investing News

Subscribe to:

Posts (Atom)