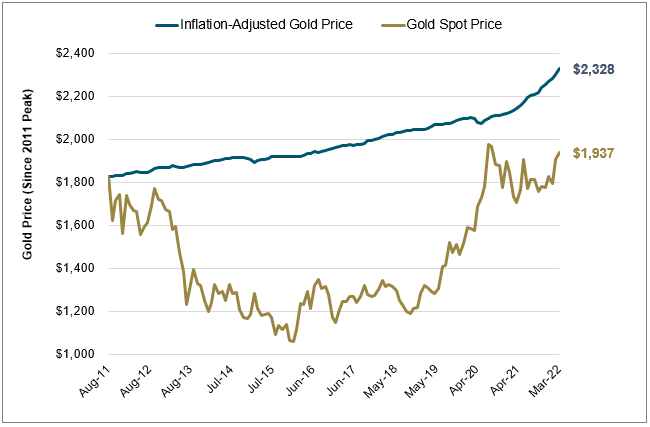

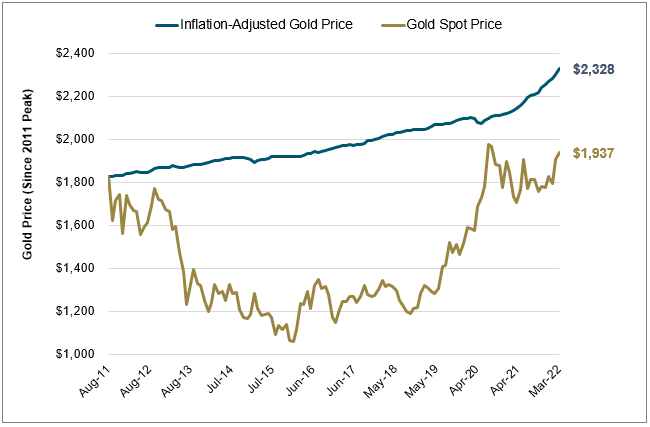

In our opinion, the gold price, despite its strong rise over the past two years, still fails to adequately reflect these risks.

In nominal terms, the March 31, 2022, gold price of $1,937 exceeds the previous monthly average high of $1,825 set in August 2011 but still lags the inflation-adjusted equivalent of $2,328 based on the August 2011 high (Figure 1).

Sanctions Against Russia Undermine the U.S. Dollar

The weaponization of the dollar "refers to the U.S. government's exploitation of the currency's global dominance in order to extend the extraterritorial reach of U.S. law and policy." 1 Longstanding objections to the U.S. dollar's reserve status include critics from not only China and Russia but most of the "Global South" countries and even European allies. Conflict in the sphere of currencies is beyond the power of any single nation or group of nations to control. In this domain, Fed policy is irrelevant.

Figure 2. World – Allocated Reserves by Currency Q4 2021

Source: IMF. Included for illustrative purposes only. Past performance is no guarantee of future results.

To counteract Russian aggression in Ukraine, Western countries imposed unprecedented sanctions that included confiscation of Russian financial assets and property held in Western jurisdictions. "The U.S., Europe and Canada pledged Saturday [February 26] to prevent the Central Bank of the Russian Federation from deploying its $630 billion stockpile (60% of its international reserves) 'in ways that undermine the impact of our sanctions,' they said in a joint statement Saturday." 2

In the opinion of many, including ours, this step delivered a critical blow to trust in paper currencies and in the safety of assets entrusted to Western financial institutions that may be impossible to restore, absent a complete shakeup of existing international conventions.

The Russian response announced on March 28 and April 3 circumvents the U.S. dollar to settle international trade. Russia temporarily pegged gold at 5,000 rubles per gram or $1,300/ounce at the time of the announcement. In the weeks following the announcement, the ruble rallied 73% to recover substantially all of the damage inflicted by the sanctions announced on February 26.

The price of gold has been treading water for 10 years while the investment fundamentals have improved dramatically. That is why, in our opinion, significant upside lies ahead for gold and related equities.

Figure 1. Gold and Inflation-Adjusted Gold Price (Since 2011 Peak)

Source: Bloomberg as of 3/31/2022.

Figure 1. Gold and Inflation-Adjusted Gold Price (Since 2011 Peak)

Source: Bloomberg as of 3/31/2022.

Gold Spot Price measured by GOLDS COMDTY. Inflation-Adjusted Gold Price calculated by taking the spot price of Gold on 8/31/2011 ($1,826) and adjusting it by the month-over-month consumer price index (CPI CHNG INDEX). Included for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

Putin's war introduces yet an additional reason to stoke investment demand for the yellow metal. It is not only war in the kinetic sense, but the reserve currency and cyber aspects that have far-reaching implications for gold. Ukraine has elevated a long-simmering currency war to center stage. The dominance of the U.S. dollar (USD) as a global reserve currency — which represents ~59% of the world's allocated reserves (Figure 2) — has been contested for more than a decade, but the Russia-Ukraine War significantly ratchets up anti-dollar hostility. The end result could be the full exposure of the woeful state of U.S. credit.

Putin's war introduces yet an additional reason to stoke investment demand for the yellow metal. It is not only war in the kinetic sense, but the reserve currency and cyber aspects that have far-reaching implications for gold. Ukraine has elevated a long-simmering currency war to center stage. The dominance of the U.S. dollar (USD) as a global reserve currency — which represents ~59% of the world's allocated reserves (Figure 2) — has been contested for more than a decade, but the Russia-Ukraine War significantly ratchets up anti-dollar hostility. The end result could be the full exposure of the woeful state of U.S. credit.

Sanctions Against Russia Undermine the U.S. Dollar

The weaponization of the dollar "refers to the U.S. government's exploitation of the currency's global dominance in order to extend the extraterritorial reach of U.S. law and policy." 1 Longstanding objections to the U.S. dollar's reserve status include critics from not only China and Russia but most of the "Global South" countries and even European allies. Conflict in the sphere of currencies is beyond the power of any single nation or group of nations to control. In this domain, Fed policy is irrelevant.

Figure 2. World – Allocated Reserves by Currency Q4 2021

Source: IMF. Included for illustrative purposes only. Past performance is no guarantee of future results.

To counteract Russian aggression in Ukraine, Western countries imposed unprecedented sanctions that included confiscation of Russian financial assets and property held in Western jurisdictions. "The U.S., Europe and Canada pledged Saturday [February 26] to prevent the Central Bank of the Russian Federation from deploying its $630 billion stockpile (60% of its international reserves) 'in ways that undermine the impact of our sanctions,' they said in a joint statement Saturday." 2

In the opinion of many, including ours, this step delivered a critical blow to trust in paper currencies and in the safety of assets entrusted to Western financial institutions that may be impossible to restore, absent a complete shakeup of existing international conventions.

The Russian response announced on March 28 and April 3 circumvents the U.S. dollar to settle international trade. Russia temporarily pegged gold at 5,000 rubles per gram or $1,300/ounce at the time of the announcement. In the weeks following the announcement, the ruble rallied 73% to recover substantially all of the damage inflicted by the sanctions announced on February 26.

Once the ruble revalued in line with prevailing USD gold prices, the Central Bank of the Russian Federation removed the peg but the message was loud and clear: Russia is prepared to back its currency with gold, as or when needed.

Using a ruble-gold peg as a reference price, the U.S. dollar has been cut out of the trade loop. To import energy from Russia, buyers must pay either rubles or gold. Sellers will no longer need to park proceeds in U.S. Treasuries.

The Russian model for selling strategic raw materials sets an example for other nations with divergent political interests and currencies to follow. To the extent that the Russian prototype is imitated, it will erode trade denominated in USDs and shrink the pool of offshore capital forced to recycle U.S. domestic deficits by investing proceeds in U.S. Treasuries.

The Russian model for selling strategic raw materials sets an example for other nations with divergent political interests and currencies to follow. To the extent that the Russian prototype is imitated, it will erode trade denominated in USDs and shrink the pool of offshore capital forced to recycle U.S. domestic deficits by investing proceeds in U.S. Treasuries.

Widespread adoption of the Russian model would expose the perilous state of U.S. creditworthiness and drive up interest rates independent of any design by the Fed.

- Source, Sprott Asset Management