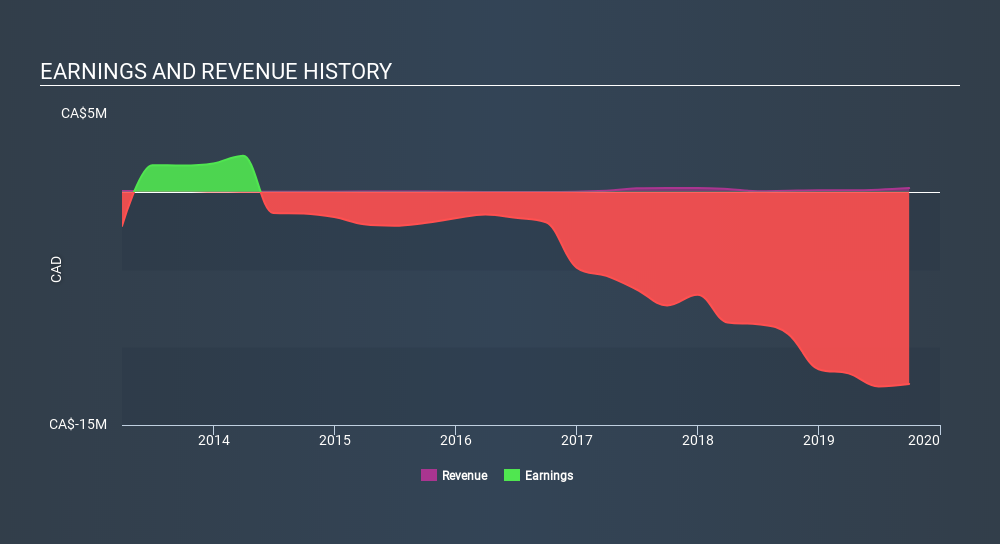

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don’t attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. Alternatively, there might be something about the company that has kept institutional investors away. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of dynaCERT, for yourself, below.

TSXV:DYA Income Statement, January 22nd 2020

Hedge funds don’t have many shares in dynaCERT. Eric Sprott is currently the largest shareholder, with 8.3% of shares outstanding. The second largest shareholder with 2.1%, is Raymond Hoffman, followed by Elliot Strashin, with an ownership of 2.1%. Elliot Strashin also happens to hold the title of Member of the Board of Directors.

Our studies suggest that the top 10 shareholders collectively control less than 50% of the company’s shares, meaning that the company’s shares are widely disseminated and there is no dominant shareholder.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

- Source, Simply Wall St, read the full article here