- Source, Precious Metals Investment Symposium

Tracking the Gold and Silver Vigilante, Eric Sprott - An Unofficial tracking of his investment commentary

Tuesday, December 18, 2018

Eric Sprott: Precious Metals Investment Symposium

Tuesday, December 11, 2018

Gold Price is Stupidly Low Relative to Monetary Inflation

We find out how Rick views physical gold and other resources that are on his radar at this moment.

- Source, SBTV

Friday, November 30, 2018

Sprott: Shaky Global Stock Markets Trigger Bid For Gold

Volatility in global stock markets is boosting demand for gold, which has stood “the test of time,” said Eric Sprott, billionaire precious metals investor and founder of Sprott Inc.

As central banks around the world stepped up gold purchases, shouldn’t investors follow suit, Sprott was asked during the company’s Weekly Wrap-Up segment.

“In India, the central bank bought some gold for the first time in over a decade. Hungarians increased their gold [tenfold to 31.5] tons. Poland also made purchases,” Sprott said. And that’s aside from continued purchases of Russia and China, he added.

In the meantime, physical demand is also picking up, with India importing 95 metric tons of gold in August, Sprott added.

These are all positive numbers that investors should be paying attention to because there’s significant risk in the markets and gold is a proven safe-haven asset, he explained.

“There are lots of reasons to think that the Federal Reserve will have to change. It is uncertain what the Fed will do. You should not automatically count on four rate increases next year,” Sprott said.

On top of that, most stock markets in the world are in a bear market, he pointed out.

“Look at China, [the stocks] was down 32% this year. There are a lot of liquidity issues in a lot of markets, and when you’re the last man standing, [investors] are going to be selling American stocks first, because they’re the ones that are theoretically liquid,” he said. “The structure of markets is very risky … [And] as things get shaky here in the markets, you see the safe-safe-haven bid coming into gold,” Sprott said.

On Tuesday, equities dropped for the fifth consecutive session. The Dow Jones Industrial Average is seeing its worst monthly decline in three years and the S&P 500 is seeing its worst monthly performance in seven years, according to reports.

Meanwhile, the December Comex gold futures touched a three-week high of $1,242 Tuesday on increased safe-haven demand.

“The yellow metal was boosted by safe-haven demand amid keener geopolitical uncertainty in the marketplace. Gold prices did back off their daily highs as the U.S. stock indexes moved up from their daily lows,” said Kitco’s senior technical analyst Jim Wyckoff. “Global stock markets saw risk aversion return to the marketplace today amid heightened geopolitical tensions. China’s stock indexes were sharply down after good gains posted Monday. South Korea’s and Japan’s stock markets were also sharply lower.”

As central banks around the world stepped up gold purchases, shouldn’t investors follow suit, Sprott was asked during the company’s Weekly Wrap-Up segment.

“In India, the central bank bought some gold for the first time in over a decade. Hungarians increased their gold [tenfold to 31.5] tons. Poland also made purchases,” Sprott said. And that’s aside from continued purchases of Russia and China, he added.

In the meantime, physical demand is also picking up, with India importing 95 metric tons of gold in August, Sprott added.

These are all positive numbers that investors should be paying attention to because there’s significant risk in the markets and gold is a proven safe-haven asset, he explained.

“There are lots of reasons to think that the Federal Reserve will have to change. It is uncertain what the Fed will do. You should not automatically count on four rate increases next year,” Sprott said.

On top of that, most stock markets in the world are in a bear market, he pointed out.

“Look at China, [the stocks] was down 32% this year. There are a lot of liquidity issues in a lot of markets, and when you’re the last man standing, [investors] are going to be selling American stocks first, because they’re the ones that are theoretically liquid,” he said. “The structure of markets is very risky … [And] as things get shaky here in the markets, you see the safe-safe-haven bid coming into gold,” Sprott said.

On Tuesday, equities dropped for the fifth consecutive session. The Dow Jones Industrial Average is seeing its worst monthly decline in three years and the S&P 500 is seeing its worst monthly performance in seven years, according to reports.

Meanwhile, the December Comex gold futures touched a three-week high of $1,242 Tuesday on increased safe-haven demand.

“The yellow metal was boosted by safe-haven demand amid keener geopolitical uncertainty in the marketplace. Gold prices did back off their daily highs as the U.S. stock indexes moved up from their daily lows,” said Kitco’s senior technical analyst Jim Wyckoff. “Global stock markets saw risk aversion return to the marketplace today amid heightened geopolitical tensions. China’s stock indexes were sharply down after good gains posted Monday. South Korea’s and Japan’s stock markets were also sharply lower.”

- Source, Kitco News

Monday, November 26, 2018

Why RNC Minerals Stock Popped a Whopping 575% in Just 3 Months

The story of RNC Minerals (TSX:RNX), better known as Royal Nickel Corp, is getting interesting by the day. If you haven’t heard about the company, RNC Minerals is a junior Canadian miner that was, until some months ago, focused on developing its Dumont Nickel project, touted to be the world’s largest nickel sulphide deposit.

All of that changed in September when RNC discovered huge gold deposits from a mine it had put up on the block. Incidentally, the company changed its business name from Royal Nickel to RNC Minerals in 2016 to reflect it’s now a multi-asset company.

As luck would have it, in September, RNC found 9,250 ounces of high-grade coarse gold, including two big specimen stones from a single cut (the process of blasting to find mineral deposits) at its Beta Hunt mine in Australia. The company immediately put its Beta Hunt sale discussions on hold.

Now, here’s where things get interesting.

Gold grade from Beta Hunt showed a significant uptick well before September. However, RNC downplayed the development, and despite a solid 60% jump in gold production from the mine in July, it still considered the mine “non-core” and was keen to sell it by August.

The September development, therefore, came out of the blue and blew the markets away.

So, what’s next for RNC? Its just-released third-quarter earnings report may have the answer.

RNC’s gold production surged 199% year over year in Q3 to hit a record of 31,360 ounces. RNC sold off 75% of that and raked in solid revenue, which lowered costs and losses.

The biggest takeaway, however, is the impact on RNC’s balance sheet. RNC paid off debt worth $11.5 million in Q3 and held cash and equivalents of $18.8 million as of Nov. 12.

The Beta Hunt discovery is, however, a “once-in-a-lifetime discovery,” as RNC called it, and the company will need more of that gold coming in to keep its operations running.

What RNC needs to keep growing

As of the end of the third quarter, RNC had a working capital deficit of $27.4 million. In simpler words, its current liabilities exceed current assets by that amount. Because current liabilities have to be paid off within a year, RNC needs more liquidity.

The gold specimens RNC held at the end of Q3 should reduce its working capital deficit by only $14.5 million when sold. Its cash balance, which includes the value of gold specimens held for sale, is enough to support drilling activities only through the first quarter. That means RNC should have struck more gold by then or be able to raise external funds to support exploration. Higher gold prices would hugely help the company.

RNC explicitly says that its “ability to operate as a going concern is dependent on its ability to raise financing.”

All of that changed in September when RNC discovered huge gold deposits from a mine it had put up on the block. Incidentally, the company changed its business name from Royal Nickel to RNC Minerals in 2016 to reflect it’s now a multi-asset company.

As luck would have it, in September, RNC found 9,250 ounces of high-grade coarse gold, including two big specimen stones from a single cut (the process of blasting to find mineral deposits) at its Beta Hunt mine in Australia. The company immediately put its Beta Hunt sale discussions on hold.

Now, here’s where things get interesting.

Gold grade from Beta Hunt showed a significant uptick well before September. However, RNC downplayed the development, and despite a solid 60% jump in gold production from the mine in July, it still considered the mine “non-core” and was keen to sell it by August.

The September development, therefore, came out of the blue and blew the markets away.

So, what’s next for RNC? Its just-released third-quarter earnings report may have the answer.

RNC’s gold production surged 199% year over year in Q3 to hit a record of 31,360 ounces. RNC sold off 75% of that and raked in solid revenue, which lowered costs and losses.

The biggest takeaway, however, is the impact on RNC’s balance sheet. RNC paid off debt worth $11.5 million in Q3 and held cash and equivalents of $18.8 million as of Nov. 12.

The Beta Hunt discovery is, however, a “once-in-a-lifetime discovery,” as RNC called it, and the company will need more of that gold coming in to keep its operations running.

What RNC needs to keep growing

As of the end of the third quarter, RNC had a working capital deficit of $27.4 million. In simpler words, its current liabilities exceed current assets by that amount. Because current liabilities have to be paid off within a year, RNC needs more liquidity.

The gold specimens RNC held at the end of Q3 should reduce its working capital deficit by only $14.5 million when sold. Its cash balance, which includes the value of gold specimens held for sale, is enough to support drilling activities only through the first quarter. That means RNC should have struck more gold by then or be able to raise external funds to support exploration. Higher gold prices would hugely help the company.

RNC explicitly says that its “ability to operate as a going concern is dependent on its ability to raise financing.”

Insider buying and RNC’s future

Of course, Beta Hunt has been a great discovery, and RNC expects it to eventually be a large gold mine. Let’s hope that happens, because beyond Beta Hunt, RNC’s future depends on Dumont — a mine that aims to exploit the growing market for nickel and cobalt — which has yet to start operations.

Meanwhile, billionaire and gold bull Eric Sprott upped his stake further in RNC Minerals in September to 10.1%. Reportedly, Selby also bought 100,000 shares each in October and November.

For now, RNC Minerals should deliver another good quarter in Q4 that should keep investors upbeat, but the path to growth thereafter will decide its long-term fate.

Of course, Beta Hunt has been a great discovery, and RNC expects it to eventually be a large gold mine. Let’s hope that happens, because beyond Beta Hunt, RNC’s future depends on Dumont — a mine that aims to exploit the growing market for nickel and cobalt — which has yet to start operations.

Meanwhile, billionaire and gold bull Eric Sprott upped his stake further in RNC Minerals in September to 10.1%. Reportedly, Selby also bought 100,000 shares each in October and November.

For now, RNC Minerals should deliver another good quarter in Q4 that should keep investors upbeat, but the path to growth thereafter will decide its long-term fate.

- Source, The Motley Fool

Friday, November 23, 2018

The Trend is Beginning to Reverse, Gold to Move Higher

“The Boys—the commercial banks—when gold first moved back up into the 1230s, they sold every contract that the hedge funds who were short wanted to buy…

There was just a huge reversal of roles there. A little bit again last week. And then all of a sudden, now we’re back up through the 100-day moving average.

And undoubtedly, the hedge funds have to buy again. It’s like: man, they got double-crossed here, you know?

They’re just getting b-slapped around by the commercial banks. It’s sort of interesting to watch.”

- Source, Eric Sprott

Tuesday, November 20, 2018

Sprott: Gold Setting Up For Late December Rally

With gold once again seeing some traction on the upside, the yellow metal could be setting up for a late-December rally, said Sprott.

“[During] the last four years, once we got to mid-December and the tax loss selling, the December FOMC meeting was behind us, we had rallies in late December and into January. Looks like we are setting up for that again,” TF Metals Report's Craig Hemke said during Sprott’s weekly wrap-up segment with Eric Sprott, billionaire precious metals investor and founder of Sprott Inc.

Starting Wednesday, the December Comex gold futures began to climb, rising from just below the $1,200 an ounce level to above $1,220, as the precious metal benefitted from increased safe-haven demand amid falling U.S. dollar index. The December gold was last trading at $1,222.90, down 0.01% on the day.

With the possibility of the year-end rally, investors should be thinking about what is currently not priced into the market when making their holiday trading choices, Sprott and Hemke said.

And the more important factor likely being overlooked at the moment is the U.S. “housing Armageddon,” noted Sprott.

“The whole interest rate thing is by far the more important one. The fact that mortgage rates have gone from 3.6% to 5.2%. The last time I checked that, that is about a 45% increase in interest costs,” he said.

The U.S. housing market is also in the spotlight next week, with the U.S. housing data being released and analysts warning that the reports could add some volatility to an already skittish marketplace.

On top of that, there’s extra stress in the bond market that investors should be keeping an eye on, added Sprott.

“Some of the best commentators are suggesting there are fundamental weaknesses. In fact, one of the better ones say; ‘You know, we all knew it was phony. Zero interest rates and the printing of money.’ The whole nine-year rally from ’09 to today, we knew it was phony. It was the elephant in the room. But because the markets kept going up, we didn’t worry about it. Now, that we’ve reversed things, we see the elephant in the room, which is: higher interest rates and restricting money growth,” he explained. “We are seeing things that suggest that the market that we have been used to for the last nine years is not the market we are in today.”

“[During] the last four years, once we got to mid-December and the tax loss selling, the December FOMC meeting was behind us, we had rallies in late December and into January. Looks like we are setting up for that again,” TF Metals Report's Craig Hemke said during Sprott’s weekly wrap-up segment with Eric Sprott, billionaire precious metals investor and founder of Sprott Inc.

Starting Wednesday, the December Comex gold futures began to climb, rising from just below the $1,200 an ounce level to above $1,220, as the precious metal benefitted from increased safe-haven demand amid falling U.S. dollar index. The December gold was last trading at $1,222.90, down 0.01% on the day.

With the possibility of the year-end rally, investors should be thinking about what is currently not priced into the market when making their holiday trading choices, Sprott and Hemke said.

And the more important factor likely being overlooked at the moment is the U.S. “housing Armageddon,” noted Sprott.

“The whole interest rate thing is by far the more important one. The fact that mortgage rates have gone from 3.6% to 5.2%. The last time I checked that, that is about a 45% increase in interest costs,” he said.

The U.S. housing market is also in the spotlight next week, with the U.S. housing data being released and analysts warning that the reports could add some volatility to an already skittish marketplace.

On top of that, there’s extra stress in the bond market that investors should be keeping an eye on, added Sprott.

“Some of the best commentators are suggesting there are fundamental weaknesses. In fact, one of the better ones say; ‘You know, we all knew it was phony. Zero interest rates and the printing of money.’ The whole nine-year rally from ’09 to today, we knew it was phony. It was the elephant in the room. But because the markets kept going up, we didn’t worry about it. Now, that we’ve reversed things, we see the elephant in the room, which is: higher interest rates and restricting money growth,” he explained. “We are seeing things that suggest that the market that we have been used to for the last nine years is not the market we are in today.”

- Source, Kitco News

Tuesday, November 13, 2018

Where Are The Experts Investing In 2018?

Where are the experts investing in 2018? Watch as Rick Rule (Sprott US Holdings Inc.), Frank Curzio (Curzio Research), Brent Johnson (Santiago Capital), Nick Hodge (Outsider Club) and Brent Cook (Exploration Insights) discuss what markets they are watching and where they see the most potential for growth.

- Source, Cambridge House

Friday, November 9, 2018

Gold is a Safe Haven Asset and This is Why You Need to Own it, Now

Most markets in the world—most stock markets—are in bear markets, save the North American markets, almost. Look at China. It was down 32% this year.

There’s a lot of liquidity issues in a lot of markets, and when you’re the last man standing, they’re going to be selling American stocks first, because they’re the one that are theoretically liquid.

- Source, Silver Seek

Monday, November 5, 2018

Eric Sprott: Good News is Not Necessarily Good News

There was just a huge reversal of roles there. A little bit again last week. And then all of a sudden, now we’re back up through the 100-day moving average.

And undoubtedly, the hedge funds have to buy again. It’s like: man, they got double-crossed here, you know? They’re just getting b-slapped around by the commercial banks. It’s sort of interesting to watch.

- Source, Silver Seek

Saturday, October 27, 2018

Eric Sprott: Light At The End Of The Tunnel

“The whole premise for gold going down, which is this phony premise about the strong dollar and that interest rates are going up, it’s just a narrative that covers for what’s going on in the paper market. It’s just a narrative, OK?

The reality is that… we talked last week about India buying 100 tonnes of gold in August. I mean, that was an incredible purchase!

And various central banks have been buyers of gold… It’s like, man, there’s not going to be enough gold around. So, I think we’re looking good.”

- Source, Eric Sprott

Monday, October 22, 2018

Who’s Kidding Who? Eric Sprott On The Weak US Dollar

“I have a view of markets, OK? It’s almost like, whatever the narrative is at the time, you know it’s likely to reverse. For example, I look at the Emerging Markets that got hammered, hammered, hammered.

Next thing you know: Whoomp! Away they go, they turn around to the upside. It’s like this Invisible Hand comes into the market.

So, you look at the gold market, and as you and I both know, we’re at the 50-day, and we’re thinking, ‘Oh my God, it’s going to break out of a down trend that it’s had for the last three or four months.

It goes right to the line and bang! Right back down again. And viciously down.”

- Source, Sprott Money

Thursday, October 18, 2018

An Explosive Situation: Eric Sprott On The State Of US Politics

“Thank God there is truly a market. You know, ‘supply and demand’, and price and all that stuff. It does work for the consumer. Even though it may not work in stocks and bonds and things like that where the Fed can interject and have the Invisible Hand working.

But when it comes to people and to budgets and their income… I just think the consumer has lots of things to be concerned about, with energy going up, interest rates going up.

Of course, health care costs are always uncontrolled… I don’t have a lot of hope for the consumer, notwithstanding the stock market going up all the time and a certain segment of the population making hay here. But the average guy is not doing that well.”

- Source, Sprott Money

Sunday, October 14, 2018

Eric Sprott: Life Learned Lessons in Resources

However, if the price of a commodity rises by twenty percent that could represent a doubling of profits. Therefore commodity price has a much more significant impact on profitability than merely increasing production.

As an investor, you want to know what a company will earn so you can determine what your returns are likely to be. If you are too conservative, you may not even make the trade.

- Source, Palisade Radio

Wednesday, October 10, 2018

Prepare Now: This Is When Gold Will Begin its Climb

Real economic recovery is lacking as low-interest rates and money printing continues. The second half of 2018 should be better than the first.

- Source, Palisade Radio

Tuesday, September 25, 2018

Eric Sprott On The Metrics That Matter

“There’s no doubt between the sentiment being as poor as it is, the technicals being as oversold as they are, the short position being as high as it is… those are three of the primary ingredients in suggesting that you should be bottoming here.

And needless to say, we’ve had a decent rally already. I don’t know exactly what the low was in gold, but it seems to me it was at least down to the 1170s somewhere.

Today we’re at 1210. So we have a decent rally going on here. So, no, I think that the CoT setup is good.

There’s still a lot of volatility in the gold price… when I see it going down quickly, like in two and three and four minutes at a time, I always think of the hedge funds trying to manipulate the price of gold.”

- Source, Sprott Money

Saturday, September 22, 2018

Everything Says We Should Be Bottoming

“I would think that the people in most countries today would be thinking about owning gold, with their currencies getting decimated on a regular basis.

I mean, you look at the damage of currencies yesterday, and there were probably ten currencies that fell over 1% in the day. You know, currencies are supposed to be stable. They’re not supposed to be like stocks or something.

But they’re truly very, very weak, whether it’s Iran or Venezuela or Turkey… There are so many reasons for people to want to get out of paper currencies and into something hard.”

- Source, Sprott Money

Wednesday, September 19, 2018

Sprott Takes Lead in $4 Million Aben Financing

Aben Resources Ltd. [ABN-TSXV; ABNAF-OTCQB; E2L2-FSE] said Wednesday August 15 that it is moving to raise $4 million via a private placement led by Bay Street gold bug Eric Sprott.

The company said the funds are being raised through a non-brokered private placement of up to 13.3 million units priced at 30 cents each. Each unit will consist of one common share and a warrant good to buy an additional share at 45 cents for two years from the dates that the units are issued.

The lead order is from Eric Sprott, who will subscribe for 6,666,667 million units, the company said. Additionally, Palisade Global Investments will subscribe for 2.75 million units and Venture Ad Network will subscribe for an additional 600,000 units.

Aben was active on the news, easing 3.85% or $0.015 to 37.5 cents in early afternoon trading on Wednesday. The 52-week range is 11 cents and 49.5 cents.

It will use proceeds of the private placement to expand its 2018 exploration and drilling program on the Forrest Kerr Gold Project in northwest British Columbia’s Golden Triangle region.

In a press release on August 9, 2018, the company said drilling has intersected multiple high-grade zones at Forrest Kerr.

Hole FK18-10, the first of eight holes to be drilled this year, has intersected four separate high-grade zones, with the best zone returning 38.7 g/t gold over 10 metres, including 62.4 g/t gold over 6.0 metres, starting at 114 metres down-hole.

The company is drilling in an area where it has discovered strong precious and base metal mineralization at the North Boundary Zone.

Aben CEO Jim Pettit recently said the high-grade gold and base metal values in the first hole of the 2018 drill hole program far exceeded the company’s expectations. He also said these results confirm the presence of a strong and robust mineralizing system at the recently discovered North Boundary Zone.

Forrest Kerr covers 23,000 hectares and is Aben’s flagship property. It is located in the Golden Triangle, a region that hosts many significant mineral deposits, including Brucejack, Eskay Creek, Snip, Galore Creek, Copper Canyon, Schaft Creek, Red Chris and others.

Aben Chairman Ron Netolitzky was involved in the discovery of the Eskay and Snip mines in the Golden Triangle and was named Canadian Prospector of the Year in 1990.

Aben can earn a 100% interest over the entire claim group by spending $3 million on exploration by June, 2020.

“We are now looking at an area that extends 230 metres south to the historic high-grade Noranda drill hole from 1991 and although the geology is complex, we believe more drilling will delineate additional high grade mineralization,” Pettit said.

The company said the funds are being raised through a non-brokered private placement of up to 13.3 million units priced at 30 cents each. Each unit will consist of one common share and a warrant good to buy an additional share at 45 cents for two years from the dates that the units are issued.

The lead order is from Eric Sprott, who will subscribe for 6,666,667 million units, the company said. Additionally, Palisade Global Investments will subscribe for 2.75 million units and Venture Ad Network will subscribe for an additional 600,000 units.

Aben was active on the news, easing 3.85% or $0.015 to 37.5 cents in early afternoon trading on Wednesday. The 52-week range is 11 cents and 49.5 cents.

It will use proceeds of the private placement to expand its 2018 exploration and drilling program on the Forrest Kerr Gold Project in northwest British Columbia’s Golden Triangle region.

In a press release on August 9, 2018, the company said drilling has intersected multiple high-grade zones at Forrest Kerr.

Hole FK18-10, the first of eight holes to be drilled this year, has intersected four separate high-grade zones, with the best zone returning 38.7 g/t gold over 10 metres, including 62.4 g/t gold over 6.0 metres, starting at 114 metres down-hole.

The company is drilling in an area where it has discovered strong precious and base metal mineralization at the North Boundary Zone.

Aben CEO Jim Pettit recently said the high-grade gold and base metal values in the first hole of the 2018 drill hole program far exceeded the company’s expectations. He also said these results confirm the presence of a strong and robust mineralizing system at the recently discovered North Boundary Zone.

Forrest Kerr covers 23,000 hectares and is Aben’s flagship property. It is located in the Golden Triangle, a region that hosts many significant mineral deposits, including Brucejack, Eskay Creek, Snip, Galore Creek, Copper Canyon, Schaft Creek, Red Chris and others.

Aben Chairman Ron Netolitzky was involved in the discovery of the Eskay and Snip mines in the Golden Triangle and was named Canadian Prospector of the Year in 1990.

Aben can earn a 100% interest over the entire claim group by spending $3 million on exploration by June, 2020.

“We are now looking at an area that extends 230 metres south to the historic high-grade Noranda drill hole from 1991 and although the geology is complex, we believe more drilling will delineate additional high grade mineralization,” Pettit said.

- Source, Resource World

Saturday, September 15, 2018

Huntsville hospital celebrates $1M donation from Sprott Foundation

The Huntsville Hospital Foundation has announced the transformative gift of $1 million from the Sprott Foundation. This represents one of the largest gifts ever received by the hospital and will be invested in urgent care and advanced medicine to ensure continued outstanding health care in Huntsville and surrounding areas.

Community leaders and seasonal residents Eric and Vizma Sprott have long been known for their generous support of health care in Ottawa and Toronto. This gift will have an equally substantial impact on health care in Muskoka.

“Eric and I love being on the lake and being part of this wonderful community. It is our great pleasure to be able to make this donation to the Hospital,” said Vizma Sprott.

Like so many seasonal residents, the Sprotts, their children and grandchildren, have had to visit the hospital.

“We have had occasion to use the hospital and we’re grateful it is there, especially as we spend more time in this community. We wanted to know what we could do to help,” said Eric Sprott.

“The staff and physicians at the hospital were honoured and humbled that the Sprotts chose to make an investment into urgent equipment needs at Huntsville Hospital,” said Katherine Craine, executive director of the foundation. “This gift is a wonderful addition to the momentum we are experiencing, and the support we are seeing from both local and seasonal residents as well as local businesses that are getting behind the hospital and its capital needs. Our fundraising continues to grow and we are grateful for the support."

The Sprotts hope their gift will inspire others to give generously to the hospital. The hospital needs up to $3 million per year to buy new equipment and upgrade technology not funded by the government. The 2017-2018 annual report for the foundation will be available in the coming weeks.

Community leaders and seasonal residents Eric and Vizma Sprott have long been known for their generous support of health care in Ottawa and Toronto. This gift will have an equally substantial impact on health care in Muskoka.

“Eric and I love being on the lake and being part of this wonderful community. It is our great pleasure to be able to make this donation to the Hospital,” said Vizma Sprott.

Like so many seasonal residents, the Sprotts, their children and grandchildren, have had to visit the hospital.

“We have had occasion to use the hospital and we’re grateful it is there, especially as we spend more time in this community. We wanted to know what we could do to help,” said Eric Sprott.

“The staff and physicians at the hospital were honoured and humbled that the Sprotts chose to make an investment into urgent equipment needs at Huntsville Hospital,” said Katherine Craine, executive director of the foundation. “This gift is a wonderful addition to the momentum we are experiencing, and the support we are seeing from both local and seasonal residents as well as local businesses that are getting behind the hospital and its capital needs. Our fundraising continues to grow and we are grateful for the support."

The Sprotts hope their gift will inspire others to give generously to the hospital. The hospital needs up to $3 million per year to buy new equipment and upgrade technology not funded by the government. The 2017-2018 annual report for the foundation will be available in the coming weeks.

- Source, Muskoka Region

Wednesday, September 12, 2018

Eric Sprott: Everything I See In The Physical Markets Is Very Optimistic

“I think of all these people who live in all these countries where their currencies are getting hammered, whether it’s the Brazilians, the Indians, the Turks, the Iranians.

We’re getting more and more people all the time, all of whom have a disposition towards gold anyway. And I read this morning that the Asian demand is very robust. Well, you know what? I’d expect it to be robust.

I mean, the Indians consume 1,000 tons a year out of roughly 3,000 tons mined. What happens if all of a sudden they’re witnessing their currency weakening? They buy 50% more. My God, the effect on the physical market would be astounding!”

- Source, Seeking Alpha

Friday, September 7, 2018

Eric Sprott: Don't Believe The Statistics

"There's no doubt between the sentiment being as poor as it is, the technicals being as oversold as they are, the short position being as high as it is… those are three of the primary ingredients in suggesting that you should be bottoming here. And needless to say, we've had a decent rally already.

I don't know exactly what the low was in gold, but it seems to me it was at least down to the 1170s somewhere. Today we're at 1210. So we have a decent rally going on here. So, no, I think that the CoT setup is good.

There's still a lot of volatility in the gold price… when I see it going down quickly, like in two and three and four minutes at a time, I always think of the hedge funds trying to manipulate the price of gold."

- Source, Seeking Alpha

Tuesday, September 4, 2018

Aben Resources Adds Eric Sprott as Strategic Shareholder

Aben Resources (TSXV: ABN; US-OTC: ABNAF) is expanding its exploration and drilling program this year at its Forrest Kerr gold project in B.C.’s Golden Triangle, with the help of a $2-million investment from financier Eric Sprott.

The financing follows assays released earlier this month from the first drill hole of the year, which returned four high-grade intervals within 190 metres downhole, including 62.4 grams gold over 6 metres within 38.7 grams gold over 10 metres from 114 metres downhole.

The highest-grade zone in hole 18-10 cut 331 grams gold per tonne over 1 metre from 118 metres downhole.

Sprott is subscribing for 2.75 million units at 30¢ apiece (each unit consists of one share and one warrant to buy another share at 45¢ per share within two years).

In addition to Sprott, Palisade Global Investments is subscribing for 2.75 million units and Venture Ad Network for 600,000 units.

“This new infusion of capital will now allow us to expand our 2018 program and stay in the field longer this year,” Jim Pettit, Aben’s president and CEO, tells The Northern Miner.

The 230 sq. km project is in northwestern B.C. and situated along the Forrest Kerr Fault, which consists of a 40 km long, north–south belt overlying rocks of the Hazelton and Stuhini Groups — a complex assemblage of volcanic accumulations, with intervening sedimentary sequences that host significant gold deposits in the Golden Triangle region.

Hole 18-10 was collared in the project’s North Boundary zone, where drilling late in the season last year found precious and base metal mineralization. The hole is 230 metres north of the historic high-grade drill hole Noranda drilled in 1991 that cut 326 grams gold over 0.5 metre.

“We are now looking at an area that extends 230 metres south to the historic, high-grade Noranda drill hole from 1991, and although the geology is complex, we believe more drilling will delineate additional high-grade mineralization,” Pettit says. “The target areas in and around the Boundary Zone are relatively shallow and continue to provide strong discovery potential, as we look to value-add the project using a systematic exploration methodology.”

The North Boundary zone — located near the centre of the property — is open in multiple directions, with numerous soil geochemical anomalies yet to be drill-tested. The zone displays continuity for gold, silver and copper mineralization and is open to the east, west, north and down-dip.

Last year, fieldwork and drilling in the North Boundary zone yielded intervals including 6.7 grams gold, 6.4 grams silver and 0.9% copper over 10 metres, including 18.9 grams gold, 16.6 grams silver and 2.2% copper over 3 metres in hole 17-4. Hole 17-5 cut 21.5 grams gold, 28.5 grams silver and 3.1% copper over 6 metres.

The Boundary Zone lies between the Forrest Kerr Fault to the west, a major deep-seated crustal feature, and the unconformable contact between the Jurassic Hazelton Group and the Triassic Stuhini Group to the east. The rock reflects a history of hydrothermal activity and brittle deformation.

“The Boundary Zone is shaping up to be much bigger than we had originally hoped, and with more drilling and fieldwork, we can begin to realize its true nature and size,” Pettit says. “The geology is complex, and more drilling will help our understanding. We are expanding the North Boundary Zone and this is just the beginning.”

Aben has agreements to earn a 100% interest in the total land package by June 2020, with $3-million in exploration.

Historic exploration on the property included 130 drill holes (20,000 metres), as well as 19,400 soil samples, 2,200 rock samples and 500 silt samples.

The junior has a strong management team. Before joining Aben in November 2002, Pettit was chairman and CEO of Bayfield Ventures, which was acquired by New Gold (TSX: NGD; NYSE-AM: NGD) in 2014.

The company’s chairman, Ronald Netolitzky, was inducted into the Canadian Mining Hall of Fame in 2015. Over more than 40 years in the industry, Netolitzky has been directly associated with three major gold discoveries in Canada that went into production: Eskay Creek, Snip and Brewery Creek.

Netolitzky describes Forrest Kerr’s multiple mineralized zones associated with mesothermal veining and next to major structural breaks as “very encouraging.”

At press time, Aben’s shares were trading at 37.5¢ within a 52-week range of 11¢ (December 2017) to 49.5¢ (September 2017).

The junior has 81.5 million common shares outstanding for a $30.6-million market capitalization.

The financing follows assays released earlier this month from the first drill hole of the year, which returned four high-grade intervals within 190 metres downhole, including 62.4 grams gold over 6 metres within 38.7 grams gold over 10 metres from 114 metres downhole.

The highest-grade zone in hole 18-10 cut 331 grams gold per tonne over 1 metre from 118 metres downhole.

Sprott is subscribing for 2.75 million units at 30¢ apiece (each unit consists of one share and one warrant to buy another share at 45¢ per share within two years).

In addition to Sprott, Palisade Global Investments is subscribing for 2.75 million units and Venture Ad Network for 600,000 units.

“This new infusion of capital will now allow us to expand our 2018 program and stay in the field longer this year,” Jim Pettit, Aben’s president and CEO, tells The Northern Miner.

The 230 sq. km project is in northwestern B.C. and situated along the Forrest Kerr Fault, which consists of a 40 km long, north–south belt overlying rocks of the Hazelton and Stuhini Groups — a complex assemblage of volcanic accumulations, with intervening sedimentary sequences that host significant gold deposits in the Golden Triangle region.

Hole 18-10 was collared in the project’s North Boundary zone, where drilling late in the season last year found precious and base metal mineralization. The hole is 230 metres north of the historic high-grade drill hole Noranda drilled in 1991 that cut 326 grams gold over 0.5 metre.

“We are now looking at an area that extends 230 metres south to the historic, high-grade Noranda drill hole from 1991, and although the geology is complex, we believe more drilling will delineate additional high-grade mineralization,” Pettit says. “The target areas in and around the Boundary Zone are relatively shallow and continue to provide strong discovery potential, as we look to value-add the project using a systematic exploration methodology.”

The North Boundary zone — located near the centre of the property — is open in multiple directions, with numerous soil geochemical anomalies yet to be drill-tested. The zone displays continuity for gold, silver and copper mineralization and is open to the east, west, north and down-dip.

Last year, fieldwork and drilling in the North Boundary zone yielded intervals including 6.7 grams gold, 6.4 grams silver and 0.9% copper over 10 metres, including 18.9 grams gold, 16.6 grams silver and 2.2% copper over 3 metres in hole 17-4. Hole 17-5 cut 21.5 grams gold, 28.5 grams silver and 3.1% copper over 6 metres.

The Boundary Zone lies between the Forrest Kerr Fault to the west, a major deep-seated crustal feature, and the unconformable contact between the Jurassic Hazelton Group and the Triassic Stuhini Group to the east. The rock reflects a history of hydrothermal activity and brittle deformation.

“The Boundary Zone is shaping up to be much bigger than we had originally hoped, and with more drilling and fieldwork, we can begin to realize its true nature and size,” Pettit says. “The geology is complex, and more drilling will help our understanding. We are expanding the North Boundary Zone and this is just the beginning.”

Aben has agreements to earn a 100% interest in the total land package by June 2020, with $3-million in exploration.

Historic exploration on the property included 130 drill holes (20,000 metres), as well as 19,400 soil samples, 2,200 rock samples and 500 silt samples.

The junior has a strong management team. Before joining Aben in November 2002, Pettit was chairman and CEO of Bayfield Ventures, which was acquired by New Gold (TSX: NGD; NYSE-AM: NGD) in 2014.

The company’s chairman, Ronald Netolitzky, was inducted into the Canadian Mining Hall of Fame in 2015. Over more than 40 years in the industry, Netolitzky has been directly associated with three major gold discoveries in Canada that went into production: Eskay Creek, Snip and Brewery Creek.

Netolitzky describes Forrest Kerr’s multiple mineralized zones associated with mesothermal veining and next to major structural breaks as “very encouraging.”

At press time, Aben’s shares were trading at 37.5¢ within a 52-week range of 11¢ (December 2017) to 49.5¢ (September 2017).

The junior has 81.5 million common shares outstanding for a $30.6-million market capitalization.

- Source, Northernminer

Wednesday, August 29, 2018

Eric Sprott: Everything I See In The Physical Markets Is Very Optimistic

“I think of all these people who live in all these countries where their currencies are getting hammered, whether it’s the Brazilians, the Indians, the Turks, the Iranians.

We’re getting more and more people all the time, all of whom have a disposition towards gold anyway. And I read this morning that the Asian demand is very robust.

Well, you know what? I’d expect it to be robust. I mean, the Indians consume 1,000 tons a year out of roughly 3,000 tons mined. What happens if all of a sudden they’re witnessing their currency weakening?

They buy 50% more. My God, the effect on the physical market would be astounding!”

- Source, Sprott Money

Friday, August 24, 2018

Eric Sprott: It’s A Problem That’s Not Going To Go Away

“You know the debts don’t go away, right? They don’t go away, they have to be paid. The cost of debt is going up, because of interest rates rising… So it just puts a greater, greater strain on all forms of GDP, because a greater part of your GDP has to go to debt repayment, We’ve always speculated, ‘When’s it finally going to have an impact on stock valuations?’

And it hasn’t yet in North America, for sure. I would suspect it’s kind of had some impact—obviously—in places like China and European Equities and other Asian equities. So I think it’s probably likely to have an impact here in North America as well.”

- Source, Sprott Money

Tuesday, August 21, 2018

Eric Sprott: Ready for the Gold Up Cycle

“I always thought we lived in a rather enchanted world, where interest rates were zero and we kept printing money all the time. And it looks like theoretically that world has ended. And, of course, stocks haven’t done much this year.

And now we have, certainly, signs of things cracking. To wit, the 20% decline in Facebook, Netflix running into a few problems, some of the companies that are affected by exports, particularly autos…

So we have some segments of the market that are in a bear market. That’s a logical outcome of rising rates. It’s a thing you and I have talked about ad nauseam here.”

- Source, Sprott Money

Sunday, August 12, 2018

This Situation Is Extremely Rare...

"I have told people for many years that speculating in gold can be dangerous because it’s your time frame that matter to you. Saving in gold is non-risky. Buying gold because you believe that gold is an insurance product is always non-risky.

I would take that further, however, by saying that gold stocks are almost never cheap. They are usually relatively expensive. And periods of time where the gold stocks are attractively priced relative to the bullion is rare, and this is one of them.”

- Source, Rick Rule via King World News

Wednesday, August 8, 2018

This Current Situation In The Gold Market Is Extremely Rare

With some volatile trading in the US dollar and oil near $74 a barrel, today Rick Rule told King World News that the current situation in the gold market is extremely rare.

Rick Rule: “The fact that we are starting to see increasing participation by mining companies in the open market (such as Goldcorp’s purchase of 7.3 million shares of Gold Standard Ventures), where they have no added inducement to buy, is extremely important from my own point of view…

If you add to that important observation the very recent merger and acquisition activity we’ve seen — the takeover of Dalradiun by private capital and the takeover of Arizona Mining by South32 — I think it’s testimony to the fact that while momentum isn’t in this (resource) market, while speculators are deterred from lack of volume and lack of momentum, value-oriented and industry investors are attracted to the fact that it’s cheap. At least the best companies are cheap.

And the value proposition of gold relative to US Treasuries makes me continuously bullish about (the price of) gold, although I can’t tell you very much with regards to the timing. I would suggest for your readers and listeners that they spend a little less time worrying about the gold market and think a little bit more about their reasons for owning gold and their reasons for participating in the market..."

Rick Rule: “The fact that we are starting to see increasing participation by mining companies in the open market (such as Goldcorp’s purchase of 7.3 million shares of Gold Standard Ventures), where they have no added inducement to buy, is extremely important from my own point of view…

If you add to that important observation the very recent merger and acquisition activity we’ve seen — the takeover of Dalradiun by private capital and the takeover of Arizona Mining by South32 — I think it’s testimony to the fact that while momentum isn’t in this (resource) market, while speculators are deterred from lack of volume and lack of momentum, value-oriented and industry investors are attracted to the fact that it’s cheap. At least the best companies are cheap.

And the value proposition of gold relative to US Treasuries makes me continuously bullish about (the price of) gold, although I can’t tell you very much with regards to the timing. I would suggest for your readers and listeners that they spend a little less time worrying about the gold market and think a little bit more about their reasons for owning gold and their reasons for participating in the market..."

- Source, King World News

Saturday, August 4, 2018

Billionaire Eric Sprott Is Making Big Moves In The Silver Market

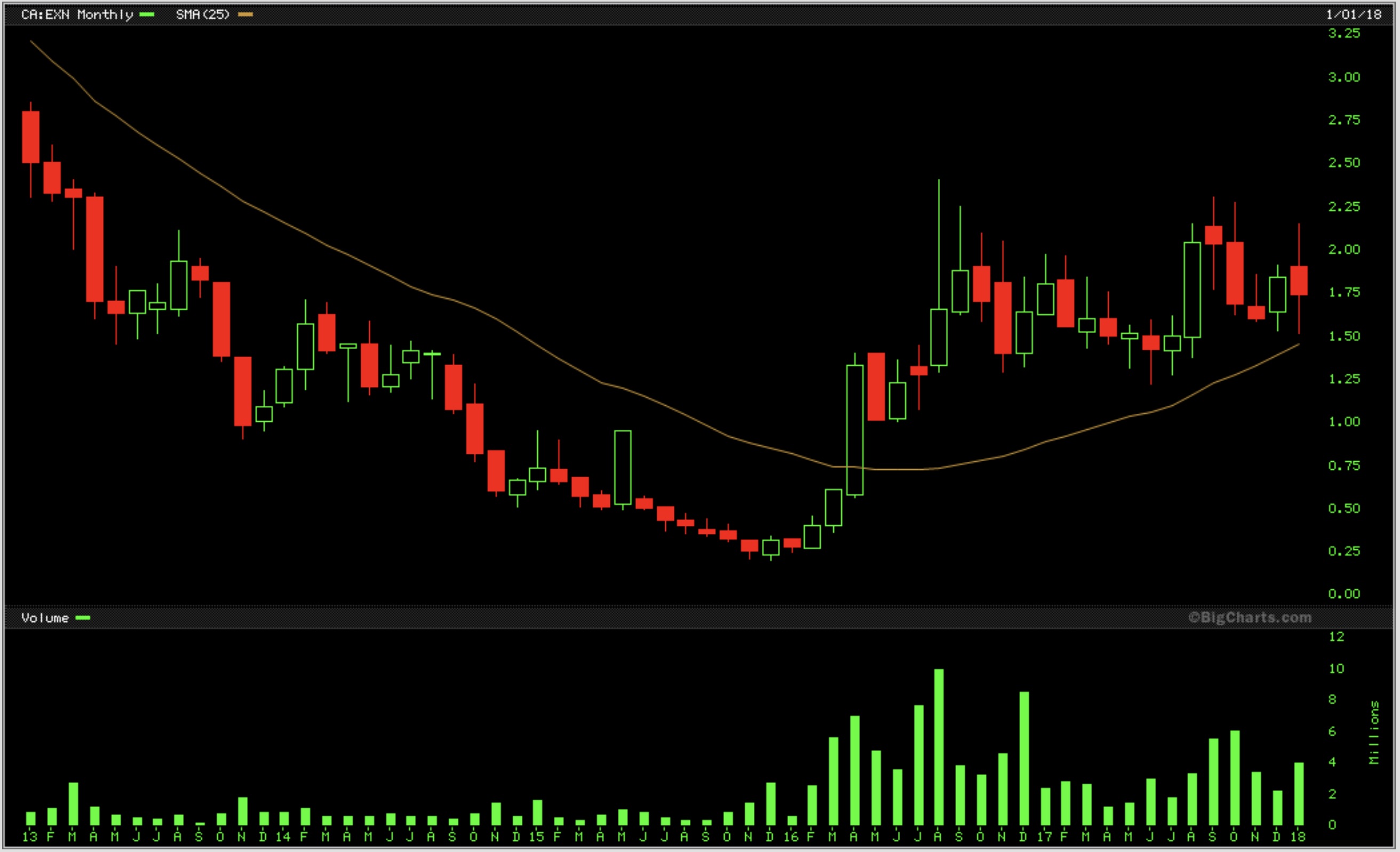

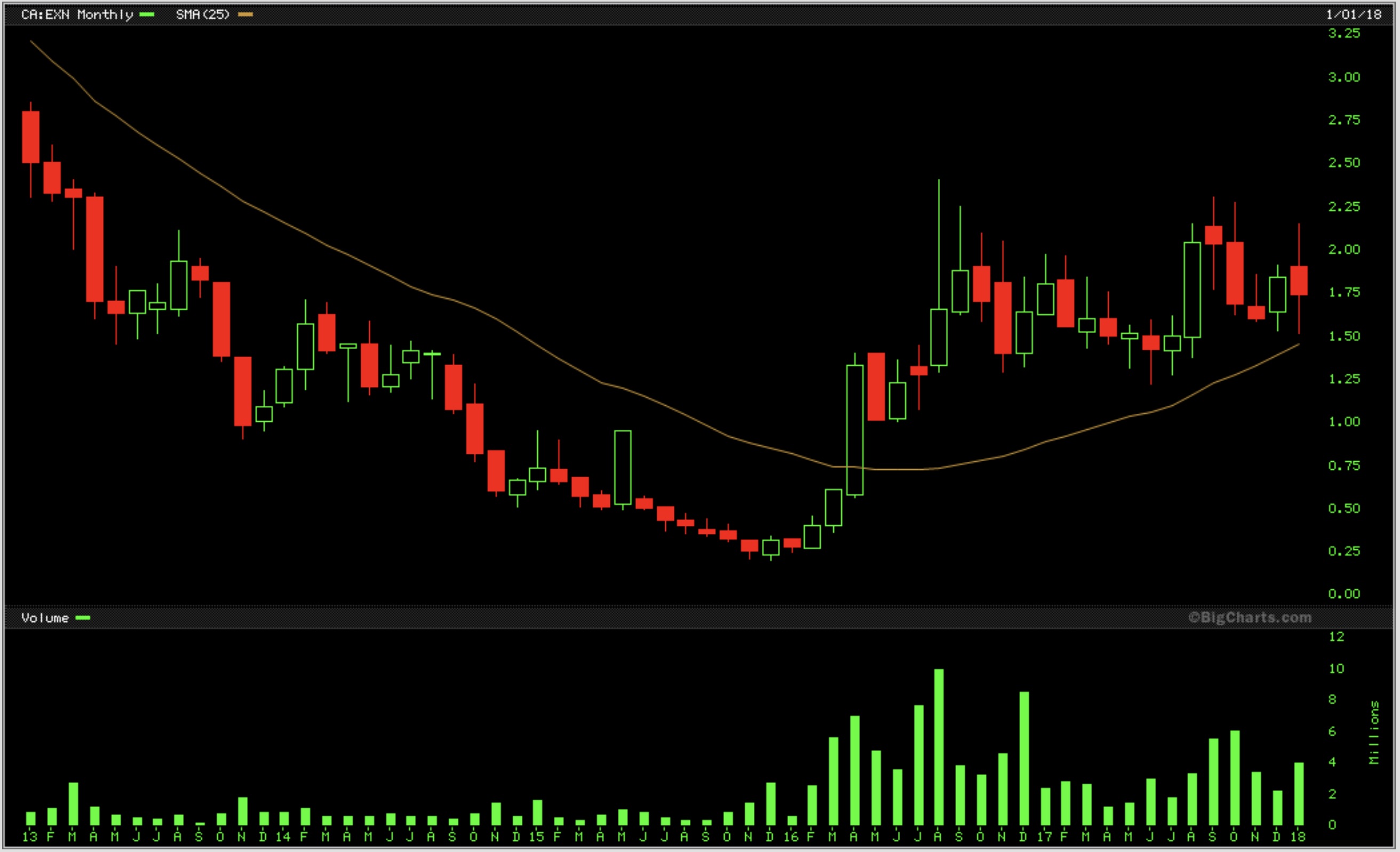

Billionaire Eric Sprott just increased his already massive stake in one of the highest grade silver producers in the world. The Canadian billionaire just purchased another 317,900 shares of Excellon Resources (symbol EXN in Canada and EXLLF in the US), bringing his total ownership of the company to 20%. However, when Sprott exercises his warrants, he will own a staggering 27% of the high-grade silver producer.

It appears that Sprott, who believes the silver price will surge above the all-time high of $50, intends to increase his ownership of Excellon to 32%, which has already been approved by the company. A look at Excellon’s chart below reveals the company has been under massive accumulation for almost 2 years.

It appears that Sprott, who believes the silver price will surge above the all-time high of $50, intends to increase his ownership of Excellon to 32%, which has already been approved by the company. A look at Excellon’s chart below reveals the company has been under massive accumulation for almost 2 years.

- Source, King World News

Monday, July 30, 2018

Eric Sprott Discusses Why There Is Truth In The Peak Gold Theory

“I’ll tell you what I think is probably going on. When we look at the bank earnings, they say, well we need volatility in markets to make money. And you need to read through that.

Well, why would you need volatility? Because we’re going to get you one way or the other, OK? And if we can get something to go up, great.

If we can get something to go down, great. And would I imagine that the banks are on the other side of the trade? Yes, I would. And do they have the money to pull it off?

Yes, they do… If you’ve got unlimited pockets, you can make things do whatever you want over a very short term basis.”

- Source, Sprott Money

Thursday, July 26, 2018

Eric Sprott: They Need Volatility to Make Money

“It’s bad enough being down to 1216 or 1217, wherever we’re trading right now. But it’s the process we’re going through.

As you know, I’ve expressed many times before that whenever the commercial banks say, ‘We need volatility in markets,’ well… they’re getting it!

And of course they orchestrate it, I believe. And that’s exactly what we’re going through, with not only gold and silver. We see it in the oil market, where it got up to 77 and everyone gets excited, it’s going to break out, and bang! It’s down ten bucks three weeks later…

So, here we are. Who knows when we get off of it.”

- Source, Sprott Money

Sunday, July 22, 2018

Rick Rule: Fake Dollar Strength, Real Weakness Elsewhere

Rule says gold and silver have been weak largely because their denominated in the strengthening Dollar.

But the Dollar strength has a good deal to do with the weakness of competing currencies and economies rather than actual strength of the U.S. economy.

However, long term, Rule is optimistic regarding the U.S. economy.

- Source, Silver Doctors

Wednesday, July 18, 2018

The US Jobs Report, I Don't Give it Any Credibility

“Between you and I and the listeners: As you know, what goes on in our world seems to have nothing to do with the real world, anyway, and a lot to do with what various traders illegally want to do on COMEX.

And obviously they’ve had their way with us here. But it looks like they’ve cleaned everyone’s clock for the last six or eight weeks, and we’re ready to go back up… It looks like we’re in a bottoming process here.”

- Source

Saturday, July 14, 2018

Eric Sprott On Global Demand For Physical Gold, Buy More Gold

Gold demand is picking up .. If you want to protect yourself from the vulnerabilities of currencies you have to own gold. Eric joins us from Dublin to discuss the following:

- The Global demand for physical gold.

- The Impending Trade Wars.

- A WWU’s listener’s question on pricing structure of physical metal

- Source

Monday, July 9, 2018

Eric Sprott: Gold Is Going to $5,000 and then $10,000 per ounce

The dollar index had support at the 93 level, but it seems to have broken to the downside. If you look logically at the U.S. financial situation, you will realize that they are bankrupt.

There will be a shocking wake-up call at some point when people realize things are unsustainable and pensions can’t be paid out. There is a lot of chaos happening in politics in Washington, and it doesn’t seem like much will be accomplished.

Foreign countries are going to continue selling U.S. dollar treasuries. It’s not ridiculous to think that gold can’t go many multiples higher. The way the system has evolved is a good reason to hold gold for the next decade.

Eric discusses the ICO frenzy in cryptocurrencies and why he feels that there are too many different versions of cryptos. He prefers gold and silver but thinks cryptocurrencies may have a place especially if they find a way to tie themselves to gold and silver. He expects the market to move similar to 2001 he expects it to be volatile.

He says “I am a huge believer that metals are manipulated by central authorities when they lose control we could be looking at a sustained gigantic bull market in precious metals.”

- Source, Palisade Radio

Thursday, June 28, 2018

Bring It On... Eric Sprott On The FOMC Rate Hike

Another week behind us, and Eric Sprott returns from the field to help us interpret it. In this edition of the wrap-up, you'll hear:

The macro fundamentals moving people towards gold.

What you should pay attention to in the mining sector (hint: it's not the news releases).

Plus: Eric's predictions for a volatile week ahead.

"My first thought is: OK, bring it on, baby! Let's have that rate increase. Let's get it over with here. Because typically, I don't think the Fed really could possibly read things as bullish as it might have started the year off thinking. Because it's really not quite coming together. Housing's weak, auto's week, retail sales are nothing special, you've got inflation affecting lots of areas... We have lots of reason for the Fed to be expressing concern. So, fine... Let's bring it on, let's see what happens. And I'm pretty certain that gold and silver will survive yet another rate increase. And prosper, quite frankly."

"My first thought is: OK, bring it on, baby! Let's have that rate increase. Let's get it over with here. Because typically, I don't think the Fed really could possibly read things as bullish as it might have started the year off thinking. Because it's really not quite coming together. Housing's weak, auto's week, retail sales are nothing special, you've got inflation affecting lots of areas... We have lots of reason for the Fed to be expressing concern. So, fine... Let's bring it on, let's see what happens. And I'm pretty certain that gold and silver will survive yet another rate increase. And prosper, quite frankly."

- Source, Seeking Alpha

Sunday, June 24, 2018

Summer Rally? Gold and Silver To Prosper After Yet Another Fed Rate Hike

Despite another Federal Reserve rate hike already priced in for Wednesday, the U.S. central bank has “lots of reason” to be concerned, said billionaire precious metals investor and founder of Sprott Inc Eric Sprott, adding that gold and silver will “prosper” following the very likely hike.

We could possibly be looking at a summer rally here, according to Sprott, who told the Fed “to bring on” the likely rate hike.

“Let’s have that rate increase. Let’s get it over with, here. Because, typically, I don’t think the Fed really could possibly read things as bullish as they might have started the year off thinking. Because it’s really not quite coming together,” he said in a Sprott Money’s Weekly Wrap-Up on Friday. “Housing’s weak, auto’s week, retail sales are nothing special, you’ve got inflation affecting lots of areas… We have lots of reason for the Fed to be expressing concern.”

The Fed language will be key to pay attention to during Wednesday’s announcement, founder of Sprott added.

“I’m pretty certain that gold and silver will survive yet another rate increase. And prosper, quite frankly,” he said.

Latest historical trend is also on Sprott’s side as gold has rallied between 10-30% during the last five out of six Fed rate hikes.

The macro fundamentals are also working in favor of the precious metals, which could support prices going forward, Sprott pointed out.

“The macro fundamentals going on in the world that might also cause people to go to gold. For example, if you are Brazilian and your currency is falling 5% in a week, maybe you’d be better off owning gold. Things going on in [Turkey and Italy] are becoming potentially upsetting for Europe,” he said. “More and more exports data are suggesting that the world economy is slowing down, which would cause rates not to be continually pushed up.”

Out of the precious metals, silver was a big winner recently, gaining about 1.85% during the last 30 days and moving up above its 50-day moving average. Silver also had over 220,000 contracts of Comex Open Interest, which totaled about 1.1 billion ounces, according to Sprott.

July Comex silver was last trading at $16.74, down 0.44% on the day, while August Comex gold futures were at $1,302.70, down 0.02% on the day.

We could possibly be looking at a summer rally here, according to Sprott, who told the Fed “to bring on” the likely rate hike.

“Let’s have that rate increase. Let’s get it over with, here. Because, typically, I don’t think the Fed really could possibly read things as bullish as they might have started the year off thinking. Because it’s really not quite coming together,” he said in a Sprott Money’s Weekly Wrap-Up on Friday. “Housing’s weak, auto’s week, retail sales are nothing special, you’ve got inflation affecting lots of areas… We have lots of reason for the Fed to be expressing concern.”

The Fed language will be key to pay attention to during Wednesday’s announcement, founder of Sprott added.

“I’m pretty certain that gold and silver will survive yet another rate increase. And prosper, quite frankly,” he said.

Latest historical trend is also on Sprott’s side as gold has rallied between 10-30% during the last five out of six Fed rate hikes.

The macro fundamentals are also working in favor of the precious metals, which could support prices going forward, Sprott pointed out.

“The macro fundamentals going on in the world that might also cause people to go to gold. For example, if you are Brazilian and your currency is falling 5% in a week, maybe you’d be better off owning gold. Things going on in [Turkey and Italy] are becoming potentially upsetting for Europe,” he said. “More and more exports data are suggesting that the world economy is slowing down, which would cause rates not to be continually pushed up.”

Out of the precious metals, silver was a big winner recently, gaining about 1.85% during the last 30 days and moving up above its 50-day moving average. Silver also had over 220,000 contracts of Comex Open Interest, which totaled about 1.1 billion ounces, according to Sprott.

July Comex silver was last trading at $16.74, down 0.44% on the day, while August Comex gold futures were at $1,302.70, down 0.02% on the day.

- Source, Kitco News

Thursday, June 21, 2018

Monday, June 18, 2018

Eric Sprott: This Is When Gold Will Begin its Climb

Real economic recovery is lacking as low-interest rates and money printing continues. The second half of 2018 should be better than the first. Commodity prices are looking good across many assets like copper, lead, and zinc. Many exciting things are going on in the commodity space.

Lithium, nickel, and vanadium are all also doing quite well. Much of the speculative investment in cryptocurrencies has now moved away from that sector. A decline in the economy and stock market could happen soon. Those two things will be critical to watch as a drop should get people thinking about gold and silver. Eric likes the recent bulk sample results from Novo Resources.

Marindi metals have found fine gold and recently nuggets. Marindi feels that the basin-wide theory is correct and that could mean a 250km by 250km with the potential for multiples of tens of millions of ounces.

Kirkland is doing very well regarding earnings and their stock still seems cheap compared to other companies. He discusses the mines and production details that they are working on. It takes work to find the opportunities, and you have to be on the hunt for them.

Your fortunes can change quickly in the natural resource sector. When things turn good, the stock prices often change fast. If you don’t have time to look, you need to invest with someone that can do that for you.

- Source, Palisade Radio

Monday, June 4, 2018

Eric Sprott Talks About The Chaos In European Markets And The Volatile World

- Source, Eric Sprott

Thursday, May 31, 2018

When Interest Rates Go Up, Gold Doesn’t: It’s Totally Fallacious

The argument that when interest rates go up, gold goes down is a “totally fallacious” one, said Eric Sprott, billionaire precious metals investor and founder of Sprott Inc.

“I don't believe the argument, but it's an argument that's made … Interest rates go up, gold doesn't go up, it's totally fallacious. But you get it in the markets,” Sprott said during Sprott Money’s Weekly Wrap-Up on Friday.

What’s actually next in store for gold prices will be determined by how investors react to future financial conditions in the U.S. as the Federal Reserve proceeds to tighten its monetary policy, according to Sprott.

And a good sign for the yellow metal is that the economy might not be ready for higher interest rates, he noted.

“What is the market going to do as the Fed literally tightens? Other things are going to go down, car sales are going down. It's getting tougher for the average American,” Sprott said. “In one state they're raising [Obama care premiums] 64%, in another one, 98%. Who could afford this stuff? We say there's no inflation. I mean that’s a 60% rise, if you already spend 17% of your salary on healthcare, that would be an increase in your inflation index of 6% for the year.”

What worries Sprott is how the markets will react when these risks materialize. And the likely scenario for the billionaire investor is the Fed pausing its tightening cycle, which will benefit gold.

“I found it very, very instructive that the UK passed on raising rates … And the Fed may, in fact, have to pause here somewhere along the line because [the economy is] not nearly as strong as we're all thinking it is,” Sprott said.

The American central bank might at the end of the day say: “Well, you know, if the numbers aren't looking that good, we're not raising,” according to Sprott. “And it could be that that's ultimately what happens with the Fed. And, of course, that would take away one of the arguments for gold not going up.”

According to the CME Fed Watch Tool, there could still be three more rate hikes coming this year.

On Monday, Cleveland Fed President Loretta Mester also expressed her support for gradual rate increases.

“In my view, the medium-run outlook supports the continued gradual removal of policy accommodation; it seems the best strategy for balancing the risks to both of our policy goals and avoiding a build-up of financial stability risks,” Mester said in prepared remarks for a speech in Paris. “We want to give inflation time to move back to goal ... this argues against a steep path.”

Earlier this month, the Fed kept interest rates unchanged within a range between 1.50% and 1.75%, while also making cautious comments regarding inflation pressures.

“I don't believe the argument, but it's an argument that's made … Interest rates go up, gold doesn't go up, it's totally fallacious. But you get it in the markets,” Sprott said during Sprott Money’s Weekly Wrap-Up on Friday.

What’s actually next in store for gold prices will be determined by how investors react to future financial conditions in the U.S. as the Federal Reserve proceeds to tighten its monetary policy, according to Sprott.

And a good sign for the yellow metal is that the economy might not be ready for higher interest rates, he noted.

“What is the market going to do as the Fed literally tightens? Other things are going to go down, car sales are going down. It's getting tougher for the average American,” Sprott said. “In one state they're raising [Obama care premiums] 64%, in another one, 98%. Who could afford this stuff? We say there's no inflation. I mean that’s a 60% rise, if you already spend 17% of your salary on healthcare, that would be an increase in your inflation index of 6% for the year.”

What worries Sprott is how the markets will react when these risks materialize. And the likely scenario for the billionaire investor is the Fed pausing its tightening cycle, which will benefit gold.

“I found it very, very instructive that the UK passed on raising rates … And the Fed may, in fact, have to pause here somewhere along the line because [the economy is] not nearly as strong as we're all thinking it is,” Sprott said.

The American central bank might at the end of the day say: “Well, you know, if the numbers aren't looking that good, we're not raising,” according to Sprott. “And it could be that that's ultimately what happens with the Fed. And, of course, that would take away one of the arguments for gold not going up.”

According to the CME Fed Watch Tool, there could still be three more rate hikes coming this year.

On Monday, Cleveland Fed President Loretta Mester also expressed her support for gradual rate increases.

“In my view, the medium-run outlook supports the continued gradual removal of policy accommodation; it seems the best strategy for balancing the risks to both of our policy goals and avoiding a build-up of financial stability risks,” Mester said in prepared remarks for a speech in Paris. “We want to give inflation time to move back to goal ... this argues against a steep path.”

Earlier this month, the Fed kept interest rates unchanged within a range between 1.50% and 1.75%, while also making cautious comments regarding inflation pressures.

- Source, Kitco News

Monday, May 28, 2018

Pension Funds Are Losing Money, A Disaster in the Making

"The pension crisis is not going away. Of course, you start raising rates and it puts an even greater stress on pensions. You know, pensions own bonds-we're in a bear market in bonds! They're losing money.

In fact, there's a chart you can see every day that shows the net gain of stocks and bonds together. And so far this year, I think it's probably zero-if not negative-the combined total of stock market gains and bond market losses. So these pension funds that were underfunded… now they're not even making any money!"

- Source, Eric Sprott

Sunday, May 20, 2018

When The Currency Starts Going You Want To Be Long Gold & Silver

“I’m a bear on the economy. We have a jobs number today that’s classified as weak. We have soft data that’s weak. We have hard data that’s weak. Logic says Flyover America is having a tough time. So, those all would argue for lower rates.

You have a Fed that, of course, could change their mind quickly if the market continues to weaken here. The only thing arguing for higher rates, of course, is just the sheer inability of the U.S. government to fund itself, because of the excessive demands from a cash perspective.”

- Source, Silver Doctors

Wednesday, May 16, 2018

It’s Not Difficult To Understand Why Gold Could Break-Out And Rally $1000 From Here

“We don’t have the economic strength that everyone is suggesting that we have. Even 2% growth is pretty paltry here … A lot of it is because of government spending money that they don’t have. Which helps GDP, by the way.

But sooner or later, if you’re spending money you don’t have, you’re not going to be able to spend it the next time, because you truly don’t have it. And the bond market’s going to make you pay for the money, and then you’ll come to your senses and stop spending.

So I think… we’re all going to find out that the rising market was built on false premises.”

- Source, Sprott

Saturday, May 12, 2018

Eric Sprott: “I Can See There’s A Bit Of A Tightness Showing Up In All Of The Metals”

Eric says if the longs decide they would rather have their metal, things could erupt because the shorts have sold metal that doesn’t even exist. Here’s an update…

Eric Sprott interviewed by Craig Hemke on The Weekly Wrap-Up

It’s been another week of rising inflation and interest rates, but the commodities markets look good, with silver in particular poised for a breakout.

This week, Eric tells you:

- What a possible short squeeze means for you

- Why you should be watching the bond market right now

- And why India might be the next big buyer of gold

- Source, Sprott Money

Tuesday, May 8, 2018

Gold’s 2% Spike Was Too Much For The Cartel To Allow So They Smashed Gold Back Down

Eric says it’s very frustrating day in and day out to witness the blatant manipulation, but in the long run, owning gold & silver will pay off. Here’s why…

Eric Sprott interviewed by Craig Hemke on The Weekly Wrap Up

It’s Friday the 13th, and after an almost perfect week, things are looking bumpy again. Eric stops by to calm our frazzled nerves on this, the unluckiest day.

In this chat you’ll hear:

- Why you shouldn’t rely on fiat currencies

- Eric’s thoughts on price suppression in the precious metals space

- His top picks for mining companies to look into

- Source, Sprott Money

Wednesday, May 2, 2018

Saturday, April 28, 2018

Mint Sales Are Terrible But They May Not Be Taking Orders As They Have No Gold To Sell

“The big worry when I look at the stock market in general … I would be very concerned about some of the things that are happening on a macro scale. And one of them, of course, is what happened to cryptocurrencies … It’s a wipeout!

People doing exactly the wrong thing with their money … And it just tells you about markets. Let’s go to the stock market … [Facebook, Google, Amazon…] They’re getting picked off one by one. When the big ones start going, you better head for the hills … I just think that this stock market is looking terribly vulnerable. I wouldn’t want to be in it. There are so many things that can go wrong here.”

- Source, Sprott Money

Wednesday, April 25, 2018

Eric Sprott: People Are Going Backwards Here

By far, the majority of the jobs are part-time. Who knows what part-time means? Maybe it's five hours or ten hours or whatever. The fact that the wage increase was only .1%, which by the way is 1.2% annualized, which is less than inflation, i.e. - people are going backwards here. It should be worrisome to the average person. Of course, that's what's been happening for decades here, that the workers' wages are going up slower than inflation, and everyone's essentially moving backwards in terms of total net compensation. So, yes it looked like a good report on the surface, but it wasn't particularly strong when you get into the guts of the matter.

- Source, Seeking Alpha

Saturday, April 21, 2018

Eric Sprott: Gold Is Within Spitting Distance Of A New High

The only investment traders can safely bet on going up is gold, said Eric Sprott, billionaire precious metals investor and founder of Sprott Inc.

“What’s going up? One thing — gold. And silver. That’s what we would expect to happen. It’s impossible to tighten monetary policy with the situation the [Fed] left us in,” Eric Sprott said during Sprott Money’s Weekly Wrap-Up on Friday.

“Everything points to gold. We are within the spitting distance of a new high here. We are very close to setting the record straight that gold’s gone up for two years and we might start launching into much higher and loftier regions as the stock market unfolds,” Sprott said.

And it’s not just about physical gold for Sprott, who noted that there is leverage in gold stocks. “A $100 increase in the price of gold would add 25%-50% to their profits. The stocks are basically at their lowest. The stocks [will] rally very quickly when they go. I’m positive,” he said.

The drivers for higher gold prices are the Federal Reserve’s unsustainable rate increases, trade war fears and a vulnerable stock market.

“If we have three more days like yesterday, we’ll be in a [stock] bear market… It’s amazing to me. And it’s exactly what we would wish for,” Sprott said. “I would put [gold’s] performance down on the crumbling stock market and the incessant increase in short-term interest rates.

Sprott added that the financial market can’t handle Fed’s planned rate hikes, pointing out that the bear market is already overpowering bonds, cryptocurrencies and stocks.

“This financial world can’t take more interest rate increases. We have $350 trillion of debt and another 100 basis point increase in interest cost [would translate to] $3.5 trillion a year of extra interest costs. You could lose half your profits with 100 basis points increase,” he said. “You are going to have consequences in financial markets. That’s by far the overriding consideration. [But, then you have to] throw in the trade wars and the chaos in the White House on top of that.”

Gold prices just finished an outstanding week, posting best weekly gains in nearly two years, up more than $30 on the week following the Fed’s decision to raise rates by 25 basis points.

As Asian markets opened early Monday, April gold futures last traded at $1,346.50 an ounce, down 0.25% on the day, while spot gold on Kitco.com was at $1,345.80 an ounce, down 0.06% on the day.

“What’s going up? One thing — gold. And silver. That’s what we would expect to happen. It’s impossible to tighten monetary policy with the situation the [Fed] left us in,” Eric Sprott said during Sprott Money’s Weekly Wrap-Up on Friday.

“Everything points to gold. We are within the spitting distance of a new high here. We are very close to setting the record straight that gold’s gone up for two years and we might start launching into much higher and loftier regions as the stock market unfolds,” Sprott said.

And it’s not just about physical gold for Sprott, who noted that there is leverage in gold stocks. “A $100 increase in the price of gold would add 25%-50% to their profits. The stocks are basically at their lowest. The stocks [will] rally very quickly when they go. I’m positive,” he said.

The drivers for higher gold prices are the Federal Reserve’s unsustainable rate increases, trade war fears and a vulnerable stock market.

“If we have three more days like yesterday, we’ll be in a [stock] bear market… It’s amazing to me. And it’s exactly what we would wish for,” Sprott said. “I would put [gold’s] performance down on the crumbling stock market and the incessant increase in short-term interest rates.

Sprott added that the financial market can’t handle Fed’s planned rate hikes, pointing out that the bear market is already overpowering bonds, cryptocurrencies and stocks.

“This financial world can’t take more interest rate increases. We have $350 trillion of debt and another 100 basis point increase in interest cost [would translate to] $3.5 trillion a year of extra interest costs. You could lose half your profits with 100 basis points increase,” he said. “You are going to have consequences in financial markets. That’s by far the overriding consideration. [But, then you have to] throw in the trade wars and the chaos in the White House on top of that.”

Gold prices just finished an outstanding week, posting best weekly gains in nearly two years, up more than $30 on the week following the Fed’s decision to raise rates by 25 basis points.

As Asian markets opened early Monday, April gold futures last traded at $1,346.50 an ounce, down 0.25% on the day, while spot gold on Kitco.com was at $1,345.80 an ounce, down 0.06% on the day.

- Source, Kitco News

Wednesday, April 18, 2018

Friday, April 13, 2018

Sprott Monthly Market Update with Rick Rule: Resource Opportunities in Uranium, Cobalt, and Gold

Sprott has seen broadly increasing client and institutional interest which has been lead by strong private placements. This interest is being driven by 2017 commodity performance, and now the equities show good value.

Rick feels that some of the companies like Agnico-Eagle are likely to do quite well over the next couple of years. Increasingly they are being run as real businesses instead of leveraged call options on gold. Sprott is currently focusing on exploration and discovery plays. They are assessing prospect generators companies. They are also looking for companies with decent drilling results that the market has overlooked.

Secondly companies with very competent teams of people who are serially successful. Lastly, they want companies that are already well enough funded to answer their unanswered questions. Rick feels that the exploration sector will wait until 2019 before it moves dramatically. They are getting better terms on private placements and can attract warrants that are tradeable and detachable. With trade-able warrants, they are often traded for more than their intrinsic value.

The outlook for phosphates and Ag-minerals are extremely bleak, and there is significant oversupply. As a consequence of this bleak supply and demand outlook, there may be opportunities in buying essential commodities when they are below the cost of production. He discusses the potential demand picture for uranium, copper, nickel and why the world has plenty of lithium.

Cobalt is the first commodity that Rick has seen where the industry is happy to pay more for the product so long as supply can be increased. However, cobalt, as an investment theme has issues with geography as most of it, comes from the Congo, Russia, and Cuba. These are not countries that investors particularly favor.

- Source, Palisade Radio

Thursday, April 12, 2018

Jig Is Up For The Cryptos So If You Want Out Of The System YOU MUST Own Gold & Silver