Tracking the Gold and Silver Vigilante, Eric Sprott - An Unofficial tracking of his investment commentary

Tuesday, December 22, 2020

Wednesday, December 16, 2020

Rick Rule: Avoid these investing mistakes or you will be a "Victim"

“If I had just hung out with the Ross Beatys, the Bob Quartermains, the Robert Friedlands, the Lukas Lundins, all of them I’ve done business with, by the time I was 35 and not bothered with the rest of the universe, I would have worked less hard and made more money,” Rule said.

- Source, Kitco News

Thursday, December 3, 2020

David Brady: Insights Into the Precious Metals Market and Shares Moving Forward

- Source, Sprott Money

Friday, November 27, 2020

Chris Vermeulen: How Will Precious Metals Fare Moving Forward in 2020 and Into 2021?

- Source, Sprott Money

Sunday, November 22, 2020

Sprott Money News: The Fed, Elections and Precious Metals Moving Forward

- Source, Sprott Money News

Sunday, November 15, 2020

Rick Rule on the U.S. Elections and the Long Term Impact on the Mining Sector

- Source, Sprott Money

Tuesday, November 10, 2020

Eric Sprott on the Latest Action in the Mining Sector and Which Companies to Focus on

- Source, Sprott Money

Thursday, November 5, 2020

Ask the Expert: Chris Vermeulen, Sprott Money

- Source, Sprott Money

Monday, November 2, 2020

Rick Rule: Even Without a Reset Metals Will Do Well

Legendary investment analyst and CEO of Sprott Asset Mgt, Rick Rule, joins Liberty and Finance host Dunagun Kaiser for a look ahead through and beyond the end of 2020.

Rick also fields many questions submitted by viewers, and renews his offer to rank natural resource portfolios for free!

- Source, Reluctant Preppers

Monday, October 19, 2020

Craig Hemke: Unlimited, Endless, Infinite Amount of Dollar Creation

Hemke says, “Don’t get cute here. Don’t sit there and think gold is going to pull back to $1,800 (per ounce), so I am going to wait.

No man, buy some today, and then if it pulls back, buy some more. We are on this merry-go-round of madness that is not going to slow down.

It’s just going to spin faster and faster, and your only protection, your only financial protection is to not save in their phony baloney fiat money, the dollar. Your protection is to save in sound money.

Money that cannot be devalued with the stroke of a pen is gold and silver. That’s what I advise.

This financial political complex is going to try to keep all of these plates spinning as long as they can.

The only way they can do that going forward from 2020 on is an almost unlimited, endless, infinite amount of dollar creation. ”

- Source, USA Watchdog

Saturday, October 10, 2020

Ask The Expert: Rob McEwen, CEO of McEwen Mining

- Source, Sprott Money News

Monday, October 5, 2020

Tuesday, September 29, 2020

Monday, September 14, 2020

Rick Rule: Investing in Gold Stocks and Millennials Should Do This

Doug Casey, founder of Casey Research, and Rick Rule, president of Sprott U.S., said that great opportunities lie in the gold mining sector, as well as emerging and frontier markets, like Africa.

- Source, Kitco News

Thursday, September 10, 2020

Doug Casey and Rick Rule: The Greater Depression and Fate of the Global Economy

Doug Casey, founder of Casey Research, and Rick Rule, president of Sprott U.S., discussed with Kitco News the underlying fundamental problems with not just our economy, but society at large, that have been brewing for years.

- Source, Kitco News

Saturday, September 5, 2020

Warren Buffett Bets Against The U.S. Dollar Plus An Interview with Rick Rule

Buffett sold off several positions in U.S. banks and airlines, and, perhaps more interestingly, bought a stake in a large gold mining stock.

Jerry breaks down the significance of this move and later is joined by Rick Rule (President/CEO of Sprott U.S. Holdings) for a discussion on investing in the natural resources sector.

- Source, Follow the Money

Monday, August 31, 2020

Craig Hemke: Central Banks Are Robbing The People? Revaluation Gold On The Horizon

Craig then talks about the Central Bank on how they are robbing the people as the currency devalues. There will be a time where gold is going to be revalued.

Thursday, August 27, 2020

Eric Sprott: The Latest Surge in Precious Metals and the Many Gains Yet to Come

- Source, Sprott Money

Sunday, August 23, 2020

Eric Sprott: Volatile Week in Precious Metals, Specific Miners Set to Gain

- Source, Sprott Money

Friday, August 21, 2020

Rick Rule: Gold and Silver Bullion Are Only Just Getting Started

- Source, Liberty and Finance

Tuesday, August 18, 2020

Don't Get Shaken Off the Raging Gold & Silver Bull Market

Craig Hemke sat down with Paul 'Half Dollar' Eberhart on Tuesday, August 4th, 2020, for a robust discussion on gold, silver, the US dollar, and more.

Some of the topics discussed in today's interview include: People have been looking for a correction in gold since $1800, since $1900, and since $2000, with many technical analysts screaming "overbought" or "way too bullish" - what does Craig think about the gold market right now?

What are the latest shenanigans in the silver market, and are the silver market riggers in a bind? What is yield curve control, and why should stackers and other smart investors be paying attention to it?

What's going on with the currencies and the debt markets in general, and the US Dollar specifically?

The food supply has seen several shocks over the past year or so with natural disasters and supply chain disruptions, but now there's a potential catastrophic problem brewing at the 3 Gorges Dam?

For discussion on all of those topics and a more, tune-in to the interview in its entirety!

- Source, Silver Doctors, Craig Hemke via Eric Sprott's, Sprott Money

Friday, August 14, 2020

Fed Not Fighting Inflation Equals $18,000 Gold Price

If that happens again, that would put the gold price at nearly $18,000 per ounce. Hemke says, “This whole system is hyper-leveraged by the central banks.

So, we have no idea how many owners there are for each ounce of gold. The amount of gold with clear title, we have no idea.

What happens when everybody shows up for their gold? If I don’t know how many ounces of gold there are, how am I supposed to know what the right price is?”

What Hemke can predicted with certainty is “more inflation” and that the Fed will not raise rates to fight inflation until at least after 2022.

I asked Hemke for his year-end predictions for the price of gold, and he said “$2,300 to $2,400 per ounce.”

For silver, Hemke predicts, “Silver will be $34 to $36 per ounce.” What the premiums will be on top of that is another story.

- Source, USA Watchdog, Craig Hemke of Eric Sprott's, Sprott Money

Friday, August 7, 2020

Real Rates Push Gold Higher

We've been writing about this for months, but with so many generalists still pushing the opinion that gold only moves as an inverse to the U.S. dollar, it's time to write about it again.

As we often do, let's start with links to past articles on this topic so that you can get caught up and/or re-acquainted with the subject:

• https://www.sprottmoney.com/Blog/real-rates-drive-...

• https://www.sprottmoney.com/Blog/real-interest-rat...

Real interest rates in the U.S. turned sharply lower on June 5 and the trend in COMEX gold has been toward higher highs ever since. These inflation-adjusted interest rates are now at all-time lows, so it's no coincidence that COMEX gold is at all-time highs. (Chart courtesy of ZeroHedge:)

Again, real interest rates are THE KEY DRIVER of gold prices over time. This has always been the case, and it will continue to be the case. Do not fall for the simplistic, generalist view that the price of gold simply moves inversely to the U.S. dollar. If that were the case, then the price of COMEX gold should be significantly lower.

The U.S. Dollar Index is currently trading at about 93.50, which is the lowest level since June of 2018. If the gold price was simply an inverse of the dollar, then why is it not trading at $1300...which is where it was trading in June of 2018?

The answer: Because changes to the relative value of the dollar only provide a tail or head wind for the gold price. See the chart below and look for any evidence of an everyday direct 1:1 correlation:

Instead, let's look for a correlation with real interest rates. The best available proxy for real interest rates on a daily basis is the ETF with the ticker symbol "TIP". This fund is a portfolio of U.S. Treasury Inflation Protected Securities or "TIPS". Simply put, when real rates are rising, the share price of the fund falls. When real rates are falling, the share price rises. Note that the share price has risen consistently since Friday, June 5. Note, too, that the price of COMEX gold has risen with it.

But the correlation is not something that just appeared over the past sixty days. Let's look at the same, five-year time horizon where we compared COMEX gold with the dollar. What do we find?

OK, so having proven that point, here's where it gets interesting...

The U.S. is about to plunge into a period of significant stagflation—like the 1970s, a time of low economic growth and significant price inflation. At the same time, the U.S. Federal Reserve is about to announce a major policy change of "allowing" inflation to exceed 2% while at the same time instituting a program of "Yield Curve Control" to keep interest rates low. See this most recent post of two weeks ago for more details:

• https://www.sprottmoney.com/Blog/a-major-fed-policy-shift-craig-hemke-july-21-2020.html

Putting this all together, you can be assured that real interest rates are going to move even deeper into negative territory. In this podcast with Grant Williams, the respected analyst Russell Napier projects that the U.S. inflation rate is soon headed to 4%. Combine that with a 0.50% nominal rate on a 10-year U.S. treasury and you get a real rate of -3.5%!

• https://podcasts.apple.com/us/podcast/the-grant-williams-podcast/id1508585135

Now scroll back up and notice that the current ALL-TIME LOWS for real rates in the U.S. are just below -1.0%...and COMEX gold is approaching $2000. Given the obvious and direct correlation with real rates, where do you think the gold price may be at -3.5%?

My point is this...

DO NOT let the know-nothing generalists and stock jobbers talk you out of your long-term positions. Of course prices will fluctuate, ebb, and flow as they always do...but the value of the U.S. dollar relative to other fiat currencies will only have a very small impact. Instead, sharply lower real interest rates will provide incentive for physical gold accumulation worldwide. THIS will drive prices higher in the weeks and months ahead. Failure to understand this CRITICAL point will cost you dearly as this bull market in the precious metals continues.

As we often do, let's start with links to past articles on this topic so that you can get caught up and/or re-acquainted with the subject:

• https://www.sprottmoney.com/Blog/real-rates-drive-...

• https://www.sprottmoney.com/Blog/real-interest-rat...

Real interest rates in the U.S. turned sharply lower on June 5 and the trend in COMEX gold has been toward higher highs ever since. These inflation-adjusted interest rates are now at all-time lows, so it's no coincidence that COMEX gold is at all-time highs. (Chart courtesy of ZeroHedge:)

Again, real interest rates are THE KEY DRIVER of gold prices over time. This has always been the case, and it will continue to be the case. Do not fall for the simplistic, generalist view that the price of gold simply moves inversely to the U.S. dollar. If that were the case, then the price of COMEX gold should be significantly lower.

The U.S. Dollar Index is currently trading at about 93.50, which is the lowest level since June of 2018. If the gold price was simply an inverse of the dollar, then why is it not trading at $1300...which is where it was trading in June of 2018?

The answer: Because changes to the relative value of the dollar only provide a tail or head wind for the gold price. See the chart below and look for any evidence of an everyday direct 1:1 correlation:

Instead, let's look for a correlation with real interest rates. The best available proxy for real interest rates on a daily basis is the ETF with the ticker symbol "TIP". This fund is a portfolio of U.S. Treasury Inflation Protected Securities or "TIPS". Simply put, when real rates are rising, the share price of the fund falls. When real rates are falling, the share price rises. Note that the share price has risen consistently since Friday, June 5. Note, too, that the price of COMEX gold has risen with it.

But the correlation is not something that just appeared over the past sixty days. Let's look at the same, five-year time horizon where we compared COMEX gold with the dollar. What do we find?

OK, so having proven that point, here's where it gets interesting...

The U.S. is about to plunge into a period of significant stagflation—like the 1970s, a time of low economic growth and significant price inflation. At the same time, the U.S. Federal Reserve is about to announce a major policy change of "allowing" inflation to exceed 2% while at the same time instituting a program of "Yield Curve Control" to keep interest rates low. See this most recent post of two weeks ago for more details:

• https://www.sprottmoney.com/Blog/a-major-fed-policy-shift-craig-hemke-july-21-2020.html

Putting this all together, you can be assured that real interest rates are going to move even deeper into negative territory. In this podcast with Grant Williams, the respected analyst Russell Napier projects that the U.S. inflation rate is soon headed to 4%. Combine that with a 0.50% nominal rate on a 10-year U.S. treasury and you get a real rate of -3.5%!

• https://podcasts.apple.com/us/podcast/the-grant-williams-podcast/id1508585135

Now scroll back up and notice that the current ALL-TIME LOWS for real rates in the U.S. are just below -1.0%...and COMEX gold is approaching $2000. Given the obvious and direct correlation with real rates, where do you think the gold price may be at -3.5%?

My point is this...

DO NOT let the know-nothing generalists and stock jobbers talk you out of your long-term positions. Of course prices will fluctuate, ebb, and flow as they always do...but the value of the U.S. dollar relative to other fiat currencies will only have a very small impact. Instead, sharply lower real interest rates will provide incentive for physical gold accumulation worldwide. THIS will drive prices higher in the weeks and months ahead. Failure to understand this CRITICAL point will cost you dearly as this bull market in the precious metals continues.

- Source, Craig Hemke via Eric Sprott's, Sprott Money

Saturday, August 1, 2020

Eric Sprott: The Upcoming Miners Earning Season, How Will They Fare?

- Source, Sprott Money

Monday, July 27, 2020

Eric Sprott: Precious Metals Had An Amazing Week, the Remainder of 2020 to Get Even Better

- Source, Sprott Money

Monday, July 20, 2020

Rick Rule Says Gold Overpriced Near Term, Still Wildly Bullish Long Term

The truth is that gold bull markets, historically, have been extraordinarily volatile.

It wouldn't surprise me to see gold go to $1,900, it wouldn't surprise me to see it go to $1,650," Rule told Kitco News. In the intermediate term, Rule maintains a bullish stance.

- Source, Kitco News

Wednesday, July 15, 2020

Friday, July 10, 2020

Eric Sprott: The Numbers Are Going to Be Brutal, Businesses and People Are Hurting

- Source, Sprott Money

Monday, June 15, 2020

Hedge fund activity in Kinross Gold Corporation

At the end of the first quarter, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards KGC over the last 18 quarters. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies has the biggest position in Kinross Gold Corporation (NYSE:KGC), worth close to $251.1 million, corresponding to 0.2% of its total 13F portfolio.

Of the funds tracked by Insider Monkey, Renaissance Technologies has the biggest position in Kinross Gold Corporation (NYSE:KGC), worth close to $251.1 million, corresponding to 0.2% of its total 13F portfolio.

The second most bullish fund manager is Sprott Asset Management, managed by Eric Sprott, which holds a $44.2 million position; 4% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism contain Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital, Ken Griffin's Citadel Investment Group and John Overdeck and David Siegel's Two Sigma Advisors.

In terms of the portfolio weights assigned to each position Sprott Asset Management allocated the biggest weight to Kinross Gold Corporation (NYSE:KGC), around 4.05% of its 13F portfolio. Odey Asset Management Group is also relatively very bullish on the stock, earmarking 3.85 percent of its 13F equity portfolio to KGC.

- Source, Yahoo News

Friday, June 12, 2020

How Much Are Canadian Palladium Resources Inc. Insiders Spending On Buying Shares?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Canadian Palladium Resources Inc. (CVE:LAN), you may well want to know whether insiders have been buying or selling

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, most countries require that the company discloses such transactions to the market.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, ‘insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

The Last 12 Months Of Insider Transactions At Canadian Palladium Resources

In the last twelve months, the biggest single purchase by an insider was when insider Eric Sprott bought CA$1.5m worth of shares at a price of CA$0.12 per share. That means that even when the share price was higher than CA$0.075 (the recent price), an insider wanted to purchase shares. It’s very possible they regret the purchase, but it’s more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. Eric Sprott was the only individual insider to buy shares in the last twelve months.

You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Insider Ownership of Canadian Palladium Resources

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. From our data, it seems that Canadian Palladium Resources insiders own 13% of the company, worth about CA$1.0m. Overall, this level of ownership isn’t that impressive, but it’s certainly better than nothing!

What Might The Insider Transactions At Canadian Palladium Resources Tell Us?

There haven’t been any insider transactions in the last three months — that doesn’t mean much. But insiders have shown more of an appetite for the stock, over the last year. While we have no worries about the insider transactions, we’d be more comfortable if they owned more Canadian Palladium Resources stock.

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, most countries require that the company discloses such transactions to the market.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, ‘insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

The Last 12 Months Of Insider Transactions At Canadian Palladium Resources

In the last twelve months, the biggest single purchase by an insider was when insider Eric Sprott bought CA$1.5m worth of shares at a price of CA$0.12 per share. That means that even when the share price was higher than CA$0.075 (the recent price), an insider wanted to purchase shares. It’s very possible they regret the purchase, but it’s more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. Eric Sprott was the only individual insider to buy shares in the last twelve months.

You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. From our data, it seems that Canadian Palladium Resources insiders own 13% of the company, worth about CA$1.0m. Overall, this level of ownership isn’t that impressive, but it’s certainly better than nothing!

What Might The Insider Transactions At Canadian Palladium Resources Tell Us?

There haven’t been any insider transactions in the last three months — that doesn’t mean much. But insiders have shown more of an appetite for the stock, over the last year. While we have no worries about the insider transactions, we’d be more comfortable if they owned more Canadian Palladium Resources stock.

In addition to knowing about insider transactions going on, it’s beneficial to identify the risks facing Canadian Palladium Resources. Be aware that Canadian Palladium Resources is showing 5 warning signs in our investment analysis, and 4 of those are significant…

- Source, Simply Wall St

Tuesday, May 26, 2020

Rick Rule: What I Do When Markets Make No Sense

- Source, Reluctant Preppers

Friday, May 22, 2020

Eric Sprott Announces Investment in Ely Gold Royalties Inc

Eric Sprott announces that, today, 2176423 Ontario Ltd., a corporation which is beneficially owned by him, purchased 9,375,000 units of Ely Gold Royalties Inc. (Ely Gold), pursuant to a private placement, at a price of $0.80 per unit for aggregate consideration of $7,500,000. Each unit consists of one common share and one-half of common share purchase warrant. Each whole warrant entitles the holder to acquire one common share at an exercise price of $1.00 per share for a period of three years, subject to acceleration in certain circumstances.

Mr. Sprott now beneficially owns and controls 36,496,594 common shares and 19,711,442 common share purchase warrants of Ely Gold (representing approximately 23.2% of the outstanding shares on a non diluted basis and approximately 31.8% on a partially diluted basis). This acquisition resulted in a beneficial ownership increase in holdings of greater than 2% of the outstanding common shares from what was reported on the last early warning report. Prior to this acquisition, Mr. Sprott beneficially owned and controlled 27,121,594 common shares and 15,023,942 common share purchase warrants representing approximately 28.0% of the then outstanding shares on a partially diluted basis.

The units were acquired by Mr. Sprott, through 2176423 Ontario for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of Ely Gold including on the open market or through private acquisitions or sell securities of Ely Gold including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

Ely Gold is located at 2833-595 Burrard Street, Vancouver, BC, V7X 1K8. A copy of the early warning report with respect to the foregoing will appear on Ely Gold's profile on SEDAR at www.sedar.com and may also be obtained by calling Mr. Sprott's office at (416) 945-3294 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

Mr. Sprott now beneficially owns and controls 36,496,594 common shares and 19,711,442 common share purchase warrants of Ely Gold (representing approximately 23.2% of the outstanding shares on a non diluted basis and approximately 31.8% on a partially diluted basis). This acquisition resulted in a beneficial ownership increase in holdings of greater than 2% of the outstanding common shares from what was reported on the last early warning report. Prior to this acquisition, Mr. Sprott beneficially owned and controlled 27,121,594 common shares and 15,023,942 common share purchase warrants representing approximately 28.0% of the then outstanding shares on a partially diluted basis.

The units were acquired by Mr. Sprott, through 2176423 Ontario for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of Ely Gold including on the open market or through private acquisitions or sell securities of Ely Gold including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

Ely Gold is located at 2833-595 Burrard Street, Vancouver, BC, V7X 1K8. A copy of the early warning report with respect to the foregoing will appear on Ely Gold's profile on SEDAR at www.sedar.com and may also be obtained by calling Mr. Sprott's office at (416) 945-3294 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

- Source, Junior Mining Network

Tuesday, May 12, 2020

Rick Rule: When Gold Prices Will Finally Be Catching Fire

“My suspicion is that the next five years will be very good for natural resources investors, with precious metals enjoying a two or three-year bull market and somewhere towards the end of that bull market, the rest of the commodities complex catching fire,” Rule told Kitco News.

- Source, Kitco News

Saturday, May 9, 2020

Sprott's Grosskopf: It's now 'mandatory' to hold gold as Fed supports infinity QE

Since early March, the U.S. central bank has thrown all it can at the growing economic crisis; in less than two months, it lowered interest rates to the zero bound range and introduced unlimited quantitative easing measures.

Peter Grosskopf, chief executive officer at Sprott Inc., said that he doesn't think the Federal Reserve has much ammunition left but will continue to buy government debt to support the economy.

"We do think the Feds end up being the subject of last support for the treasury market," he said. "The important subject in the market, the important theme is financial repression."

- Source, Kitco News

Tuesday, May 5, 2020

Sprott’s Peter Grosskopf: It will be much harder to get gold as Scotia winds down bullion desk

Peter Grosskopf, chief executive officer at Sprott Inc., said that this could add to the supply crunch for gold. The COVID-19 pandemic has already severely impacted the precious metals' global supply chain. "We were already having a tough time getting the amount of physical that we require.

I think it's going to be that much harder," said Grosskopf. "It's almost the opposite of what's happening in the oil market right now." In 2018, Scotia unsuccessfully tried to sell its precious metals business and eventually downsized the department when it couldn't find a buyer.

Grosskopf said that it is a surprise that Scotia decided to shut down its precious metals desk instead of looking for another buyer. "They had a very prestigious position as one of the top three traders in that business," he said.

- Source, Kitco News

Friday, May 1, 2020

Gold's Got Your Back in More Ways Than One

Rick Rule, CEO of Sprott Asset Management, returns to Liberty and Finance / Reluctant Preppers to answer viewers’ questions and to declare that there’s more to know about the vital role precious metals can play in our financial well being than many of us may have been told.

- Source, Reluctant Preppers

Tuesday, April 28, 2020

Crude Collapse Concerns COMEX

After watching front month NYMEX crude oil futures collapse into negative pricing on Monday, you should be sure to consider the possibility of an exact opposite scenario playing out one day soon in COMEX gold futures.

What happened Monday in NYMEX crude oil? It can be summarized this way:

Without any parties looking to buy creating an actual bid-ask spread, the bidless market is an environment where only sellers exist on the offer. Price then resets lower and lower until buyers finally emerge. In NYMEX crude, that "price" was actually NEGATIVE. Amazing.

And it was all caused by a glut of the physical commodity. With no demand for the underlying physical, the price discovered through derivative trading collapsed.

Consider now the potential for a diametrically opposite situation in COMEX gold. Why and how could this unfold?

Could this opposite scenario actually play out in COMEX gold? You may be reluctant to say yes, as this type of situation would seem unlikely and unprecedented. However, prior to Monday, April 20, the idea of negative pricing for the world's most important commodity was similarly unlikely and unprecedented.

We now know that quite literally ANYTHING is possible in 2020. From global pandemics to economic collapse to QE∞ to -$40 crude. As such, a complete implosion and restructuring of the global pricing scheme for precious metal is not out of the question in the weeks and months ahead.

What happened Monday in NYMEX crude oil? It can be summarized this way:

- The May20 crude oil contract was scheduled to go off the board and into delivery on Tuesday, April 21.

- Anyone long the contract after Tuesday the 21st would be assumed to stand for delivery through the NYMEX facility in Cushing, Oklahoma.

- But storage facilities in Cushing are reported to be "full". As such, there is no need or demand for holding these May20 contracts into delivery. Where would you put it?

- Those parties that remained long the May20 contract thus needed to sell. However, to sell you also need a buyer—someone interested in adding a long or covering an existing short.

- And in this case, there were NO BUYERS. Thus, what you saw was a true bidless market.

- The result? See below:

Without any parties looking to buy creating an actual bid-ask spread, the bidless market is an environment where only sellers exist on the offer. Price then resets lower and lower until buyers finally emerge. In NYMEX crude, that "price" was actually NEGATIVE. Amazing.

And it was all caused by a glut of the physical commodity. With no demand for the underlying physical, the price discovered through derivative trading collapsed.

Consider now the potential for a diametrically opposite situation in COMEX gold. Why and how could this unfold?

- COMEX gold also has "delivery month" contracts that serve as the "front month" for trading purposes until they go off the board and into delivery—at which time the trading volume rolls into the next scheduled month.

- In delivery, anyone still long the contract can stand for delivery through the COMEX vaults in New York. (And now might also stand for fractional ownership of bullion bars in London, too.)

- But global demand for physical gold outstrips supply at present, as many refineries, mines, and mints are closed worldwide due to Covid-19.

- Thus we are seeing a growing need/demand to hold COMEX contracts into delivery. For the current month of Apr20, total gold deliveries on COMEX exceed 3,000,000 ounces. This is more than 3X the usual demand for a "delivery month".

- If an extreme shortage develops—or if any sort of "run" on the bullion bank fractional reserve system begins—demand for delivery through the COMEX and LBMA will soar.

- Demand for the front/delivery month contract will surge. However, to buy a contract, you will also need a seller—someone interested in adding a short or selling an existing long.

- And in this case, there may be NO SELLERS. Thus, what you may see is a true offerless market.

- The potential result? The exact opposite of what you witnessed Monday in NYMEX crude oil.

Could this opposite scenario actually play out in COMEX gold? You may be reluctant to say yes, as this type of situation would seem unlikely and unprecedented. However, prior to Monday, April 20, the idea of negative pricing for the world's most important commodity was similarly unlikely and unprecedented.

We now know that quite literally ANYTHING is possible in 2020. From global pandemics to economic collapse to QE∞ to -$40 crude. As such, a complete implosion and restructuring of the global pricing scheme for precious metal is not out of the question in the weeks and months ahead.

- Source, Craig Hemke via Sprott Money

Friday, April 24, 2020

Monday, April 20, 2020

Tuesday, April 14, 2020

Eric Sprott: What Happens to the Global Economy Now? Where Are Precious Metals Going Next?

- Source, Sprott Money

Friday, April 10, 2020

Eric Sprott: The Devastating Impact of COVID-19 and How Central Banks Will React Moving Forward

- Source, Sprott Money

Friday, April 3, 2020

Mines Shutting Down, COMEX to Settle in Cash?

At the same time, crisis financial interventions are motivating even “Reluctant Preppers” to seek shelter for their funds in precious metals, resulting in a demand spike which is cleaning out the supply chain of physical gold & silver.

- Source, Reluctant Preppers

Tuesday, March 31, 2020

The Impact that the Coronavirus is Having on Precious Metals and Mining Shares

- Source, Sprott Money

Thursday, March 26, 2020

Gold Trade: Refuge in a Time of Crisis

The raging liquidity vortex seriously impacted the gold price, which retreated more than 10% from its recent peak. We note that the price of gold is always vulnerable when sentiment is overextended and it is over-bought based on technical measures such as RSI (relative strength index) and net commercial versus speculative positions. USD strength last week hurt as well. As usual, the trading of gold was likely dominated by margined entities trading "paper" as opposed to physical transactions, usually by a factor of 100:1 or more.

Most importantly, we believe that gold provided what it should during times of crisis, a form of insurance to cash in when liquidity was required. Gold has lousy margin rates for levered funds and is, by default, one of the first assets to be cashed in when leverage is reduced. We are comforted that throughout this "policy payout," it has mimicked its performance in the GFC, during which it was first sold down by holders requiring funds for other purposes and then skyrocketed once liquidity was rebalanced and QE began in earnest. We believe that long-term investors, not subject to margin pressures, will be similarly rewarded by owning gold at this time.

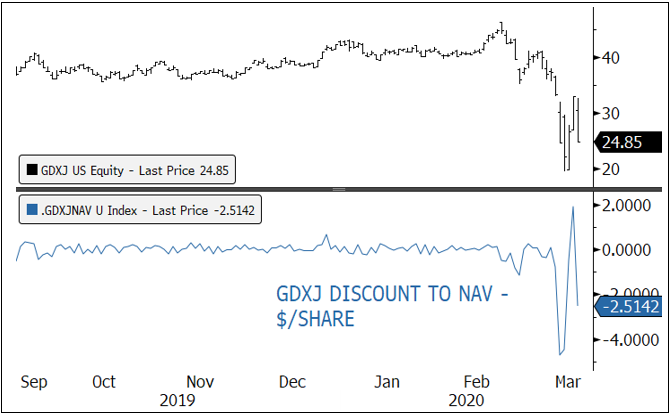

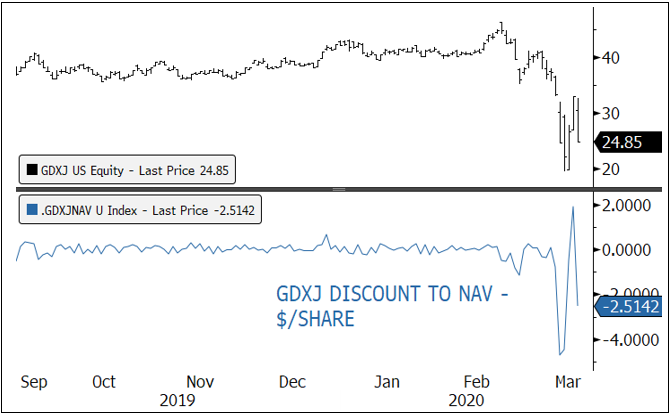

Liquidity concerns also played a prominent role in gold producer equity trading. Gold funds, of which the largest are ETFs, were sold aggressively by margined investors and computer-based traders. The largest gold mining ETFs, the GDX2 and GDXJ,3 were so oversold that they diverged from their closing NAVs by wide margins (see Figure 5). Small- and mid-cap gold stocks lost their bids entirely and fell further from already depressed levels. In our opinion, many now trade under their liquidation values. We remind our clientele that gold producers are enjoying healthy, increasing margins and that their earnings performance should handily outperform other industries in this environment.

Figure 5. Forced Liquidations Causing Dislocation in Gold ETFs

Source: Bloomberg. Data as of 3/18/2020.

Our position on gold is unchanged, which is that it should become a preferred currency and liquidity position for investors, with an essential utility as an insurance policy for more difficult markets to come. Artificially-sponsored negative real rates are already severely damaging purchasing power within portfolios. Permanent government debt "monetization" began in 2019 and will now need to accelerate. In the long term, we are convinced that this process of unabated money printing will eventually spur inflation. Admittedly, it is challenging to see beyond the short-term deflationary event and the government-doctored CPI statistics to the eventual reflationary process. Fortunately, either way, this environment is nirvana for gold as a real asset with purchasing power protection.

Sprott's Business and Strategy

In my opinion, the past two weeks have highlighted the importance of Sprott and our mission to help our clients preserve wealth in uncertain times. We are brave, contrarian and committed to providing our clients with the best investment opportunities in our sector. Nothing has changed in this strategy save for the pricing of the opportunity.

Sprott, as a company, has never been in better health. Our employees are safe and accustomed to working collaboratively from remote locations. Our margins are strong, our assets and client base are growing and we have multiple opportunities for expansion. We are committed to our dividend policy, which provides our shareholders with a healthy yield and to maintaining a strong balance sheet. We liken Sprott to a management company that earns a royalty from our assets under management and as such, we believe our shares are undervalued and are actively repurchasing them for cancellation.

We advise our clients to add to their gold positions over the coming weeks and to use periods of short-term weakness as buying opportunities.

Be safe, this too shall pass and we will get through this challenging period together.

Most importantly, we believe that gold provided what it should during times of crisis, a form of insurance to cash in when liquidity was required. Gold has lousy margin rates for levered funds and is, by default, one of the first assets to be cashed in when leverage is reduced. We are comforted that throughout this "policy payout," it has mimicked its performance in the GFC, during which it was first sold down by holders requiring funds for other purposes and then skyrocketed once liquidity was rebalanced and QE began in earnest. We believe that long-term investors, not subject to margin pressures, will be similarly rewarded by owning gold at this time.

Liquidity concerns also played a prominent role in gold producer equity trading. Gold funds, of which the largest are ETFs, were sold aggressively by margined investors and computer-based traders. The largest gold mining ETFs, the GDX2 and GDXJ,3 were so oversold that they diverged from their closing NAVs by wide margins (see Figure 5). Small- and mid-cap gold stocks lost their bids entirely and fell further from already depressed levels. In our opinion, many now trade under their liquidation values. We remind our clientele that gold producers are enjoying healthy, increasing margins and that their earnings performance should handily outperform other industries in this environment.

Figure 5. Forced Liquidations Causing Dislocation in Gold ETFs

Source: Bloomberg. Data as of 3/18/2020.

Our position on gold is unchanged, which is that it should become a preferred currency and liquidity position for investors, with an essential utility as an insurance policy for more difficult markets to come. Artificially-sponsored negative real rates are already severely damaging purchasing power within portfolios. Permanent government debt "monetization" began in 2019 and will now need to accelerate. In the long term, we are convinced that this process of unabated money printing will eventually spur inflation. Admittedly, it is challenging to see beyond the short-term deflationary event and the government-doctored CPI statistics to the eventual reflationary process. Fortunately, either way, this environment is nirvana for gold as a real asset with purchasing power protection.

Sprott's Business and Strategy

In my opinion, the past two weeks have highlighted the importance of Sprott and our mission to help our clients preserve wealth in uncertain times. We are brave, contrarian and committed to providing our clients with the best investment opportunities in our sector. Nothing has changed in this strategy save for the pricing of the opportunity.

Sprott, as a company, has never been in better health. Our employees are safe and accustomed to working collaboratively from remote locations. Our margins are strong, our assets and client base are growing and we have multiple opportunities for expansion. We are committed to our dividend policy, which provides our shareholders with a healthy yield and to maintaining a strong balance sheet. We liken Sprott to a management company that earns a royalty from our assets under management and as such, we believe our shares are undervalued and are actively repurchasing them for cancellation.

We advise our clients to add to their gold positions over the coming weeks and to use periods of short-term weakness as buying opportunities.

Be safe, this too shall pass and we will get through this challenging period together.

- Source, Peter Grosskopf, CEO Sprott Inc

Monday, March 23, 2020

More Quantitative Easing to be Unleashed, Debt to GDP Now Unsolvable

It has been a very difficult couple of weeks for the precious metals complex, the financial markets and the general population. No doubt that the impacts of the coronavirus outbreak will be shouldered by many over both the short and long terms. Some industries, such as travel and hospitality, will require assistance while others, such as medical and long-term care, will need massive investment. I trust that our collective resilience and determination will prevail and that the vast majority of us will be safe and more grateful than we were before 2020.

Sprott is Well Positioned

Sprott is well positioned for these uncertain times. As our clients and shareholders are aware, our firm has been at the forefront of the notion that systematic risks in the markets have been building for years. We believed that there was bound to be some event that served as a catalyst to a sea-change in the perception and pricing of those risks (see This Tide Will Turn, December 2019).

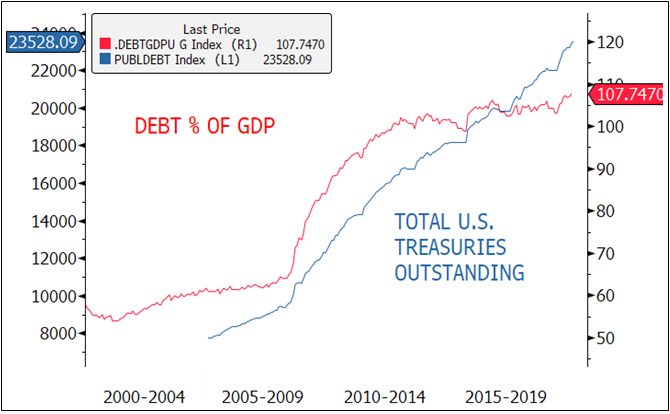

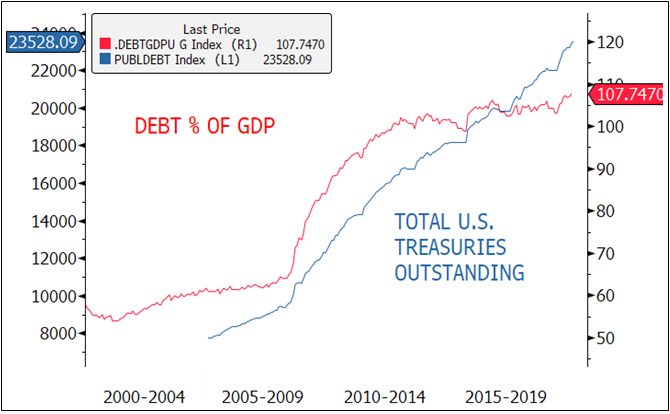

Our thesis has been underpinned by one central premise: that the $250+ trillion build-up in global debt was serving to unnaturally extend the business cycle and asset prices in the same misguided way as during prior bubbles. And, that the economy was no longer growing enough or large enough to support this massive debt balance. We believe it was already, prior to this crisis, an unsolvable equation that had reached its Minsky Moment (see Figure 1).

Figure 1. Debt to GDP Equation No Longer Solvable

Source: Bloomberg. Data as of 3/18/2020.

Concurrently, central banks have become influenced by their political masters and now serve widely to provide the financing and stimulus required to hold the equation in abeyance. Negative interest rates never made sense to us and neither do seemingly permanent budget deficits after a 10-year bull market. Sadly, the coronavirus pandemic has now provided the pin which has burst the bubble.

Long-Term View Unchanged

From the perspective of Sprott and the positioning of our clients and firm, nothing has changed over the last two weeks. Our clients have co-invested with us in gold and related assets to protect their wealth from the current global reset, a strategy that has historically always paid dividends. We are now several giant steps further into the process of financial repression which is required for the "books to balance".

Clearly, more quantitative easing ("QE") needs to be unleashed, no matter what you call it, in order to provide the liquidity the system desperately requires. Interest rates cannot rise without making the situation much worse, so central banks will do what is necessary to keep a lid on rates. Fiscal stimulus is also on the way because even after 10 years of recovery, the economy is nowhere near strong enough to handle the stresses of a coronavirus slowdown. In summary, more low rates, more printing, more budget deficits. Nothing we weren't expecting, just more severe than we anticipated...

Sprott is well positioned for these uncertain times. As our clients and shareholders are aware, our firm has been at the forefront of the notion that systematic risks in the markets have been building for years. We believed that there was bound to be some event that served as a catalyst to a sea-change in the perception and pricing of those risks (see This Tide Will Turn, December 2019).

Our thesis has been underpinned by one central premise: that the $250+ trillion build-up in global debt was serving to unnaturally extend the business cycle and asset prices in the same misguided way as during prior bubbles. And, that the economy was no longer growing enough or large enough to support this massive debt balance. We believe it was already, prior to this crisis, an unsolvable equation that had reached its Minsky Moment (see Figure 1).

Figure 1. Debt to GDP Equation No Longer Solvable

Source: Bloomberg. Data as of 3/18/2020.

Concurrently, central banks have become influenced by their political masters and now serve widely to provide the financing and stimulus required to hold the equation in abeyance. Negative interest rates never made sense to us and neither do seemingly permanent budget deficits after a 10-year bull market. Sadly, the coronavirus pandemic has now provided the pin which has burst the bubble.

Long-Term View Unchanged

From the perspective of Sprott and the positioning of our clients and firm, nothing has changed over the last two weeks. Our clients have co-invested with us in gold and related assets to protect their wealth from the current global reset, a strategy that has historically always paid dividends. We are now several giant steps further into the process of financial repression which is required for the "books to balance".

Clearly, more quantitative easing ("QE") needs to be unleashed, no matter what you call it, in order to provide the liquidity the system desperately requires. Interest rates cannot rise without making the situation much worse, so central banks will do what is necessary to keep a lid on rates. Fiscal stimulus is also on the way because even after 10 years of recovery, the economy is nowhere near strong enough to handle the stresses of a coronavirus slowdown. In summary, more low rates, more printing, more budget deficits. Nothing we weren't expecting, just more severe than we anticipated...

- Source, Peter Grosskopf, CEO of Sprott Asset Management

Friday, March 20, 2020

Eric Sprott: Collapsing Global Markets and it's Impact on Precious Metals

- Source, Sprott Money

Wednesday, March 11, 2020

Novo Agrees to Acquire Significant Stake in New Found Gold Corp.

Upon closing of the Acquisition and assuming no further share issuances by New Found or Novo, Novo will own approximately 15.97% of the issued and outstanding shares of New Found and New Found will own approximately 3.73% of the issued and outstanding common shares of Novo. The Acquisition gives Novo a significant stake in yet another promising new gold field and, coupled with the Company’s recent investment in ASX-listed Kalamazoo Resources Limited, further diversifies the Company’s passive exposure to potentially significant discoveries worldwide.

New Found is focused on exploring its wholly-owned Queensway project (the “Queensway Project”) located near the town of Gander, Central Newfoundland. The first hole from its late 2019 drill program (NFGC-19-01) on the Queensway Project intersected 92.86 g/t Au over 19.0

The Queensway Project comprises 85 km of prospective strike length with strong geological indications that much of the property falls within the prospective high-grade

The Province of Newfoundland and Labrador is a favorable exploration and mining jurisdiction. The Province recently launched the “Mining the Future 2030” initiative which envisions five new mines, direct employment of a diverse workforce of more than 6,200 people, CAD $4 billion in annual mineral shipments, and CAD $100 million in exploration expenditures by 2030 (please see https://www.gov.nl.ca/releases/2018/exec/1102n05/) and bodes well for the future of the Queensway Project.

Eric Sprott, a director of Novo, currently holds 16.79% of the issued and outstanding shares of New Found immediately prior to the Acquisition. As such, New Found is considered a non-arm’s length party to Novo pursuant to TSX Venture Exchange policies.

Pursuant to the terms of the Acquisition, the Company also has the right to appoint a director to the board of directors of New Found at any time for a period of three years from the Acquisition Date provided that the Company holds no less than 10% of New Found’s issued and outstanding shares. The Company has also agreed to certain voting restrictions for a period of three years.

“We at Novo think the Queensway Project represents a very promising new high-grade gold discovery,” commented Dr. Quinton Hennigh, President and Chairman of Novo Resources. “It appears the Queensway Project encompasses an area highly prospective for high-grade epizonal orogenic gold mineralization. We are very pleased to have the opportunity to be part of this exciting discovery and, upon completion of the Acquisition, look forward to supporting New Found as they advance work around hole NFGC-19-01 and the many other high grade showings across the Queensway Project.”

“We are thrilled to welcome Novo as a significant stakeholder in New Found,” commented Collin Kettel, Executive Chairman and Director of New Found. “Following strategic investments in New Found by Eric Sprott and Rob McEwen last year, we are excited to receive further validation of our team’s discovery at the Queensway Project in Newfoundland. We look forward to working with Dr. Quinton Hennigh and the entire Novo team as we continue to advance the Queensway Project.”

- Source, Yahoo Finance

Saturday, March 7, 2020

Eric Sprott, Terry Lynch: Protect Retail Investors, Let Them Make Money

- Source, Investing News Network

Tuesday, March 3, 2020

Coronavirus Concerns, Protests and More

The Investing News Network also took to the floor (and Twitter) to poll attendees on whether Canada is still attractive as a mining jurisdiction.

- Source, Investing News

Monday, February 24, 2020

What Kind Of Shareholder Appears On The Bonterra Resources Inc.’s Shareholder Register?

If you want to know who really controls Bonterra Resources Inc. (CVE:BTR), then you’ll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said ‘Show me the incentive and I will show you the outcome.

Bonterra Resources is a smaller company with a market capitalization of CA$123m, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutions own shares in the company. Let’s take a closer look to see what the different types of shareholder can tell us about Bonterra Resources.

What Does The Institutional Ownership Tell Us About Bonterra Resources?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

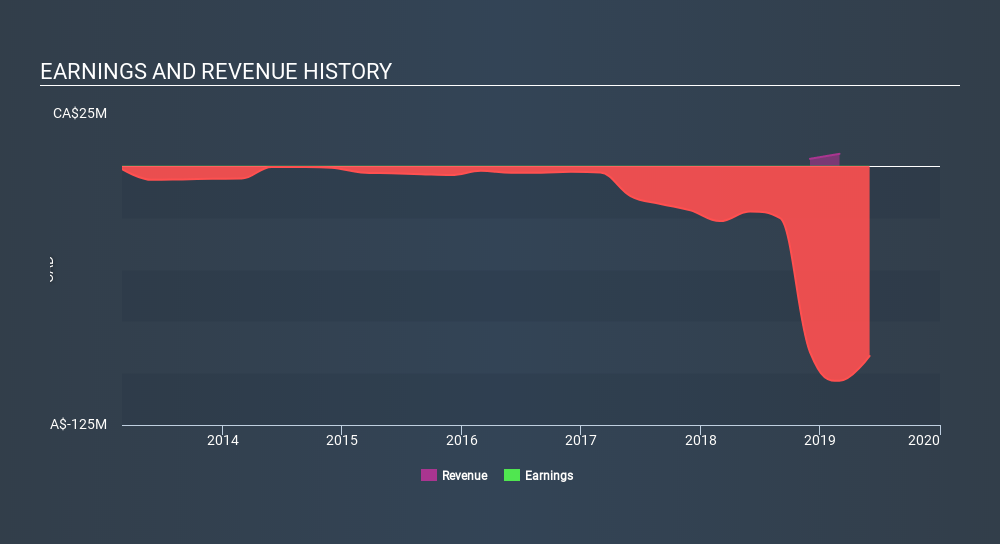

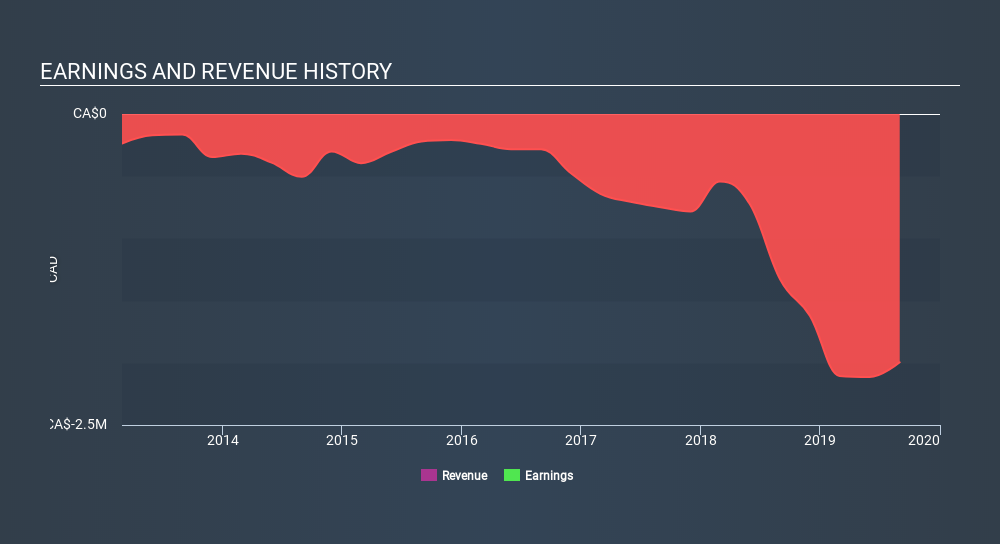

Bonterra Resources already has institutions on the share registry. Indeed, they own 21% of the company. This suggests some credibility amongst professional investors. But we can’t rely on that fact alone, since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Bonterra Resources’s historic earnings and revenue, below, but keep in mind there’s always more to the story.

It would appear that 16% of Bonterra Resources shares are controlled by hedge funds. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. Looking at our data, we can see that the largest shareholder is Wexford Capital LP with 16% of shares outstanding. Kirkland Lake Gold Ltd. is the second largest shareholder with 11% of common stock, followed by Eric Sprott, holding 6.7% of the stock.

On studying the facts and figures more closely, we found that 7 of the top shareholders account for 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Bonterra Resources is a smaller company with a market capitalization of CA$123m, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutions own shares in the company. Let’s take a closer look to see what the different types of shareholder can tell us about Bonterra Resources.

What Does The Institutional Ownership Tell Us About Bonterra Resources?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

Bonterra Resources already has institutions on the share registry. Indeed, they own 21% of the company. This suggests some credibility amongst professional investors. But we can’t rely on that fact alone, since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Bonterra Resources’s historic earnings and revenue, below, but keep in mind there’s always more to the story.

It would appear that 16% of Bonterra Resources shares are controlled by hedge funds. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. Looking at our data, we can see that the largest shareholder is Wexford Capital LP with 16% of shares outstanding. Kirkland Lake Gold Ltd. is the second largest shareholder with 11% of common stock, followed by Eric Sprott, holding 6.7% of the stock.

On studying the facts and figures more closely, we found that 7 of the top shareholders account for 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

- Source, Simply Wall St.

Saturday, February 22, 2020

Sprott Weekly Wrap Up: A Week of Tough, Tough News for Gold and Silver Investors

There is thirty-one thousand now. That’s one hell of a big increase in two weeks’ time. And I’ve seen artificial intelligence numbers that suggested that by March 15 we could have 2.5 billion cases and 53 million deaths.

That’s just an extension of numbers, that’s not my prediction.”

- Source, Junior Mining

Wednesday, February 19, 2020

Argo Gold Announces C$1 Million Financing

Toronto, Ontario--(Newsfile Corp. - February 4, 2020) - Argo Gold Inc. (CSE: ARQ) ("Argo Gold" or the "Company") is pleased to announce that it intends to complete a private placement offering of up to 11,200,000 units ("Units") at a price of $0.09 per Unit, for gross proceeds of up to $1,008,000 (the "Offering"). Eric Sprott has indicated his intention to take up all of the Offering.

Each Unit will consist of one common share (a "Common Share") of the Company and one common share purchase warrant (a "Warrant") with each Warrant entitling the holder thereof to purchase a Common Share at an exercise price of $0.12 for a period of thirty-six (36) months following the closing of the Offering. All securities issued under the Offering are subject to a four-month and one day statutory hold period.

The closing of the Offering is anticipated to take place on February 7, 2020. The closing is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the Canadian Securities Exchange.

Each Unit will consist of one common share (a "Common Share") of the Company and one common share purchase warrant (a "Warrant") with each Warrant entitling the holder thereof to purchase a Common Share at an exercise price of $0.12 for a period of thirty-six (36) months following the closing of the Offering. All securities issued under the Offering are subject to a four-month and one day statutory hold period.

The closing of the Offering is anticipated to take place on February 7, 2020. The closing is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the Canadian Securities Exchange.

- Source, Junior Mining Network

Sunday, February 16, 2020

Canadian Palladium Closes Non-Brokered Private Placement

Canadian Palladium Resources Inc. (CSE: BULL) (OTCQB: DCNNF) (FSE: DCR1) (formerly 21C Metals Inc.) (the "Company") has closed the non-brokered private placement previously announced on January 20, 2020. The private placement raised gross proceeds of $4,000,403 through the issuance of 33,336,698 units (each, a "Unit") at a price of $0.12 per share. Each Unit consists of one common share and one common share purchase warrant exercisable at a price of $0.18 for a period of 12 months from the date of grant.

Mr. Eric Sprott, through 2176423 Ontario Ltd., a corporation which is beneficially owned by him, acquired 12,500,000 Units for a total consideration of $1,500,000. Following the completion of the private placement, Mr. Sprott beneficially owns and controls 12,500,000 Common Shares and 12,500,000 Warrants of the Company representing approximately 12.6% of the issued and outstanding Common Shares of the Company on a non-diluted basis and approximately 22.2% of the issued and outstanding Common Shares on a partially diluted basis. Prior to the Financing, Mr. Sprott did not beneficially own or control any shares of the Company.

The Units were acquired by Sprott for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of Canadian Palladium including on the open market or through private acquisitions or sell securities of Canadian Palladium including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

A copy of Sprott's early warning report will appear on Canadian Palladium profile on SEDAR and may also be obtained by calling Mr. Sprott's office at (416) 945-3294 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J2).

The Company has issued 1,314,099 finder's units (the "Finder's Units"), 230,042 finder's warrants (the "Finder's Warrants") and issued $27,605 in cash as finder's fees to eligible agents who arranged for subscriptions of Units under the private placement. Each Finder's Unit consists of one common share and one Finder's Warrant. Each Finder's Warrant entitles the holder thereof to purchase one additional common share at a price of $0.18 for a period of 12 months from the date of issuance.

The Company intends to use the proceeds of the financing to advance its East Bull palladium project and for general working capital.

All of the securities issued under the private placement are subject to a four-month resale restriction and may not be traded until May 29, 2020.

Mr. Eric Sprott, through 2176423 Ontario Ltd., a corporation which is beneficially owned by him, acquired 12,500,000 Units for a total consideration of $1,500,000. Following the completion of the private placement, Mr. Sprott beneficially owns and controls 12,500,000 Common Shares and 12,500,000 Warrants of the Company representing approximately 12.6% of the issued and outstanding Common Shares of the Company on a non-diluted basis and approximately 22.2% of the issued and outstanding Common Shares on a partially diluted basis. Prior to the Financing, Mr. Sprott did not beneficially own or control any shares of the Company.

The Units were acquired by Sprott for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of Canadian Palladium including on the open market or through private acquisitions or sell securities of Canadian Palladium including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

A copy of Sprott's early warning report will appear on Canadian Palladium profile on SEDAR and may also be obtained by calling Mr. Sprott's office at (416) 945-3294 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J2).

The Company has issued 1,314,099 finder's units (the "Finder's Units"), 230,042 finder's warrants (the "Finder's Warrants") and issued $27,605 in cash as finder's fees to eligible agents who arranged for subscriptions of Units under the private placement. Each Finder's Unit consists of one common share and one Finder's Warrant. Each Finder's Warrant entitles the holder thereof to purchase one additional common share at a price of $0.18 for a period of 12 months from the date of issuance.

The Company intends to use the proceeds of the financing to advance its East Bull palladium project and for general working capital.

All of the securities issued under the private placement are subject to a four-month resale restriction and may not be traded until May 29, 2020.

- Source, Junior Mining Network

Friday, February 14, 2020

Four Junior Resource Stocks with Big Name Insider Buying

The junior resource stocks we’ve unearthed have received significant insider buying from legendary investor Eric Sprott over the past three months.

Insiders are defined as any person with access to key company information before it is released to the public, or someone who owns more than 10% of a company’s shares. Insiders include individuals such as management, officers, and directors.

Market Cap: $39.1M

30-Day Return: +9.5%

90-Day Return: +12.5%

30-Day Average Trading Volume: 281,900

90-Day Average Trading Volume: 161,090

Market Cap: $137.5M

30-Day Return: +10.2%

90-Day Return: +31.3%

30-Day Average Trading Volume: 268,160

90-Day Average Trading Volume: 191,070

Market Cap: $19.2M

30-Day Return: -28.1%

90-Day Return: -33.8%

30-Day Average Trading Volume: 166,570

90-Day Average Trading Volume: 126,900

Insiders are defined as any person with access to key company information before it is released to the public, or someone who owns more than 10% of a company’s shares. Insiders include individuals such as management, officers, and directors.

Government bodies require companies to report this information, in a timely manner, giving investors a sense of insider activity within a company. One of the wealthiest investors in the mining sector is Eric Sprott, the billionaire founder of Sprott Inc. The junior resource stocks we have discovered today have received a significant insider investment from Eric Sprott during the past three months.

Amex Exploration Inc. (TSXV:AMX) – $1.50

Gold exploration

Amex Exploration is a Canada-based mining exploration company focused on exploration activities conducted in Canada and Mexico. Its properties include the Perron Property, Normetal Property, Cameron Property, Lac Indicateur property, Eastmain Centre property, Eastmain North Property, Natora Property and Nueva Escondida property.

Gold exploration

Amex Exploration is a Canada-based mining exploration company focused on exploration activities conducted in Canada and Mexico. Its properties include the Perron Property, Normetal Property, Cameron Property, Lac Indicateur property, Eastmain Centre property, Eastmain North Property, Natora Property and Nueva Escondida property.

The Company’s flagship asset, the Perron Property, consists of approximately 120 mining claims covering an area of over 4,510 hectares in northern Quebec. Amex’s summer drilling program found high-grade gold intersected on the Gratien gold zone at Perron, with results up to 16.48 g/t Au over 14.6 m, including 315.4 g/t Au over 0.5 m and 102.96 g/t Au over 0.7 m. Eric Sprott added 2M shares at $1.00/share last November, bring his total ownership up to 6.7M shares.

Market Cap: $99.6M

30-Day Return: +6.4%

90-Day Return: +50.0%

30-Day Average Trading Volume: 63,540

90-Day Average Trading Volume: 58,030

90-Day Return: +50.0%

30-Day Average Trading Volume: 63,540

90-Day Average Trading Volume: 58,030

Benchmark Metals Inc. (TSXV:BNCH) – $0.405

Gold and silver exploration

Benchmark Metals is a mining company focused on exploring and developing its Lawyers Gold and Silver project located in the prolific Golden Triangle of northern British Columbia. The Lawyers Property and formerly producing Cheni Gold and Silver Mine is located 45 km northwest of the Kemess Gold and Copper Mine.

Gold and silver exploration

Benchmark Metals is a mining company focused on exploring and developing its Lawyers Gold and Silver project located in the prolific Golden Triangle of northern British Columbia. The Lawyers Property and formerly producing Cheni Gold and Silver Mine is located 45 km northwest of the Kemess Gold and Copper Mine.

The Property contains an existing Mineral Resource and hosts at least 16 gold and silver occurrences that were never fully mined, developed or explored. Eric Sprott added 2.3M shares at $0.30/share last December, following 13.3M shares added at $0.30/share in September, bringing his total ownership to 15.6M shares.

Market Cap: $39.1M

30-Day Return: +9.5%

90-Day Return: +12.5%

30-Day Average Trading Volume: 281,900

90-Day Average Trading Volume: 161,090

Discovery Metals Corp. (TSXV:DSV) – $0.65

Silver Mining

Discovery Metals focuses on discovering and advancing high-grade polymetallic deposits in a land package of about 150,000 hectares in the historic mining district in Coahuila State, Mexico.

Silver Mining

Discovery Metals focuses on discovering and advancing high-grade polymetallic deposits in a land package of about 150,000 hectares in the historic mining district in Coahuila State, Mexico.

The Company’s portfolio consists of three large-scale, drill-ready projects and several earlier-stage prospects. Currently, the land holdings contain numerous historical direct-ship ore workings with several kilometers of underground development, however no modern exploration or drill testing on the properties has occurred before the work of Discovery Metals.

As well, Discovery is currently exploring one the world’s largest silver resources at its 100% owned 37,000-hectare Cordero Project in Chihuahua State, Mexico. Eric Sprott added 3.3M shares at $0.45/share in December, following 7.8M shares added at $0.45/share in November, bringing his total ownership to 41.3M shares.

Market Cap: $137.5M

30-Day Return: +10.2%

90-Day Return: +31.3%

30-Day Average Trading Volume: 268,160

90-Day Average Trading Volume: 191,070

Dolly Varden Silver engages in the acquisition, development, exploration, and evaluation of mineral properties in Canada. The Company explores for gold, silver, and copper deposits. It holds 100% interests in the Dolly Varden project, covering an area of 8,800 hectares, as well as the Musketeer property located in northwestern British Columbia; and the Big Bulk porphyry copper-gold project located in Canada. Eric Sprott added 5.7M shares at $0.235/share in September, bringing his total ownership to 10.7M shares.

Market Cap: $19.2M

30-Day Return: -28.1%

90-Day Return: -33.8%

30-Day Average Trading Volume: 166,570

90-Day Average Trading Volume: 126,900

Wednesday, February 12, 2020

Could Benchmark Metals Investor Composition Influence the Stock Price?

The big shareholder groups in Benchmark Metals Inc. (CVE:BNCH) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said ‘Show me the incentive and I will show you the outcome.

Benchmark Metals is a smaller company with a market capitalization of CA$39m, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are noticeable on the share registry. Let’s delve deeper into each type of owner, to discover more about Benchmark Metals.

Benchmark Metals is a smaller company with a market capitalization of CA$39m, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are noticeable on the share registry. Let’s delve deeper into each type of owner, to discover more about Benchmark Metals.

What Does The Institutional Ownership Tell Us About Benchmark Metals?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

Hedge funds don’t have many shares in Benchmark Metals. Looking at our data, we can see that the largest shareholder is Eric Sprott with 16% of shares outstanding. Sprott Asset Management, LP is the second largest shareholder with 7.0% of common stock, followed by James Greig, holding 2.2% of the stock. James Greig also happens to hold the title of Member of the Board of Directors.

A deeper look at our ownership data shows that the top 8 shareholders collectively hold less than 50% of the register, suggesting a large group of small holders where no one share holder has a majority.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance. Our information suggests that there isn’t any analyst coverage of the stock, so it is probably little known.

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

We can see that Benchmark Metals does have institutional investors; and they hold 7.0% of the stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It’s therefore worth looking at Benchmark Metals’s earnings history, below. Of course, the future is what really matters.

Hedge funds don’t have many shares in Benchmark Metals. Looking at our data, we can see that the largest shareholder is Eric Sprott with 16% of shares outstanding. Sprott Asset Management, LP is the second largest shareholder with 7.0% of common stock, followed by James Greig, holding 2.2% of the stock. James Greig also happens to hold the title of Member of the Board of Directors.

A deeper look at our ownership data shows that the top 8 shareholders collectively hold less than 50% of the register, suggesting a large group of small holders where no one share holder has a majority.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance. Our information suggests that there isn’t any analyst coverage of the stock, so it is probably little known.

- Source, Simply Wall St

Monday, February 10, 2020

Sprott puts millions of dollars into proposed palladium project

"One of Canada’s long-time mining moguls has given a proposed palladium mine on Marathon’s doorstep a big shot in the arm.

Generation Mining announced Wednesday that billionaire investor Eric Sprott has invested $5 million into the project, which calls for an open-pit operation near the town’s airport.

Sprott’s investment is to give him a stake in the company worth nearly nine per cent, said a Generation Mining news release."

Generation Mining announced Wednesday that billionaire investor Eric Sprott has invested $5 million into the project, which calls for an open-pit operation near the town’s airport.

Sprott’s investment is to give him a stake in the company worth nearly nine per cent, said a Generation Mining news release."

- Source, Chronicle Journal

Friday, February 7, 2020

Ontario Claiming Global Stake in Palladium Sector with Latest Deal

Junior explorer Sienna Resources (TSXV:SIE,OTC Pink:SNNAF) has acquired the Marathon North palladium property in Northern Ontario, which is adjacent to Generation Mining’s (CSE:GENM) Marathon palladium project.

Interest in the area has peaked in recent months, with global platinum-group metals (PGMs) producer Impala Platinum (OTC Pink:IMPUY,JSE:IMP) merging with North American Palladium in December to create Impala Canada, which now manages the Lac des Iles palladium mine near Thunder Bay.

Increased activity in the palladium exploration and mining sector has likely been a result of the metal’s breakthrough performance in 2019. The commodity was the most expensive traded precious metal last year, and has climbed 17 percent so far in 2020.

And palladium’s price surge doesn’t seem to be over yet. After breaking its previous record highs in 2019 and again in the first few weeks of 2020, the metal, which is used to reduce emissions in vehicles, broke the US$2,550 per ounce threshold to trade for US$2,577.27 on Monday (January 20).

It slipped from its new all-time high shortly after; currently palladium is priced at US$2,296.

Sienna Resources President Jason Gigliotti explained how PGMs prices motivated the company to acquire the package, which will complement the firm’s platinum, palladium and nickel project in Sweden, where a drill program concluded in October.

“Platinum and palladium prices have been some of the best performing metal prices recently, especially palladium, which is right near an all-time high,” he said in a media release.

“The timing for our new platinum-palladium project acquisition could not be more opportune … We feel that there is a massive demand and appetite for platinum and palladium assets and Sienna’s goal is to be a significant player in this arena in 2020.”

Shares of the explorer skyrocketed 80 percent following the announcement.

Even though it is only the third top palladium-producing country, Canada’s palladium projects have dominated the news cycle lately due to their potential, grade and jurisdiction.

Impala’s Lac des Iles mine, which has been in production for more than two decades, has been called a world-class orebody, while Generation Mining’s Marathon project has been dubbed “the largest undeveloped palladium deposit in North America.”

Shares of Generation Mining also climbed this week, shooting up 28 percent following the news that Canadian billionaire Eric Sprott was investing C$5 million to acquire 8.8 percent of the company.